Key economic releases last week

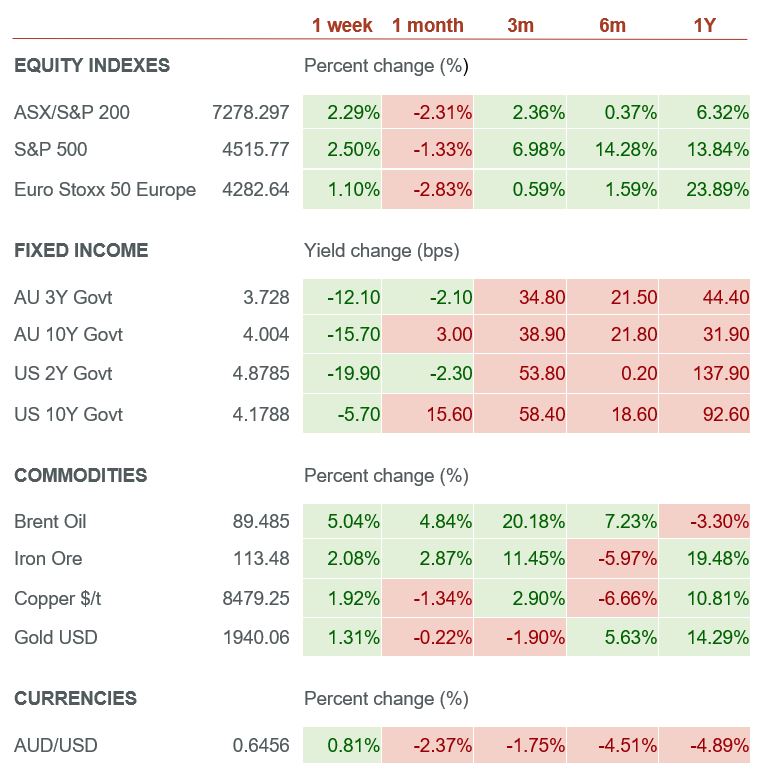

- Australian retail sales rose 0.5% MoM, rebounding from June’s surprise 0.8% fall, and more than consensus expectations for a 0.3% rise.

- US consumer confidence was worse than consensus expectations as it fell but remained slightly positive. US personal spending rose 0.8%, above the 0.7% consensus.

- US added 187,000 jobs, above the consensus for 170,000 but the previous month’s reading was revised lower. The unemployment rate rose 0.3% to 3.8% as the participation rate rose by 0.2% to 62.8%. Job openings fell sharply to 8.827m, well below the consensus for 9.465m. The previous month’s reading was also revised sharply lower, from 9.582m to 9.165m.

- US PCE rose 0.2% MoM for both core and headline readings, or 5.3% YoY and 3.3% YoY respectively, in-line with consensus.

While it will be harder for YoY inflation figures to hit the 2% target, recent MoM readings are now consistent with inflation trending close to the 2% target. Jobs data has also shown signs of weakening, with markets now expecting the Fed to remain on hold rather than hike. - US ISM Manufacturing PMI was 47.6, above consensus estimates of 47 and an improvement from the previous month’s 46.4 reading.

- EU preliminary CPI data showed a 0.3% MoM or 5.3% rise in headline inflation, in-line with consensus. Core rose 0.6% MoM and 5.3% YoY, higher than consensus estimates. The EU inflation trend implies that there is more to do for the ECB.

- China’s Manufacturing PMI remained in contraction though the 49.7 reading was marginally better than the 49.5 consensus and the previous month’s reading of 49.3. This was supported by the smaller Caixin Manufacturing PMI survey, which rose to 51 from 49.2, above consensus for 49.3. The Non-manufacturing PMI deteriorated to 51 from the previous month’s 51.5, below consensus for 51.1.

- China has also continued to announce incremental stimulus, including reducing down payments for first and second home buyers.

Key releases for the week ahead

- ANZ job ads

- RBA policy meeting

- Australian Q2 GDP

- China trade data

Chart of the week

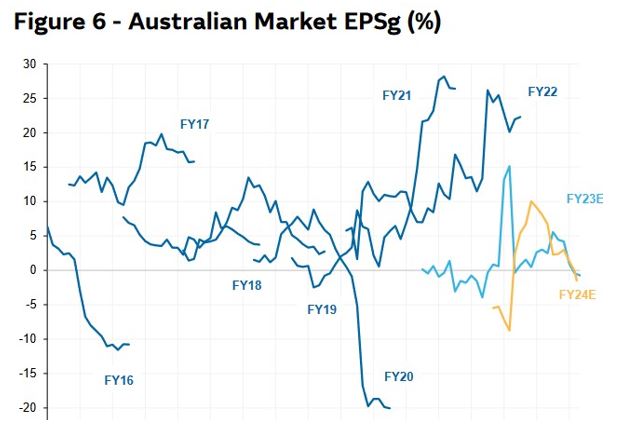

We have compiled several key takeaways from domestic earnings season over the last couple of weeks. With reporting now largely over, the key takeaways are that despite solid revenue growth, higher costs due to wages, borrowing costs and capital expenditures are driving weaker expectations for free cash flow and earnings. The chart below shows that overall earnings for the 2023 financial year disappointed, while expectations for 2024 have turned negative.

This earnings season also saw retailers and cyclicals outperform as weak expectations were met with profits that were deteriorating but not as bad as expected. Meanwhile, defensives underperformed as expectations were high and costs weighed heavier than expected, with many of these defensives having higher debt levels.

We continue to expect economic growth to weaken as the lagged impact of higher interest rates works its way through to consumers and businesses, therefore, we are seeing some opportunities emerge in defensive areas of the market such as healthcare.

–

Monday 04 September 2023, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.