Key releases last week

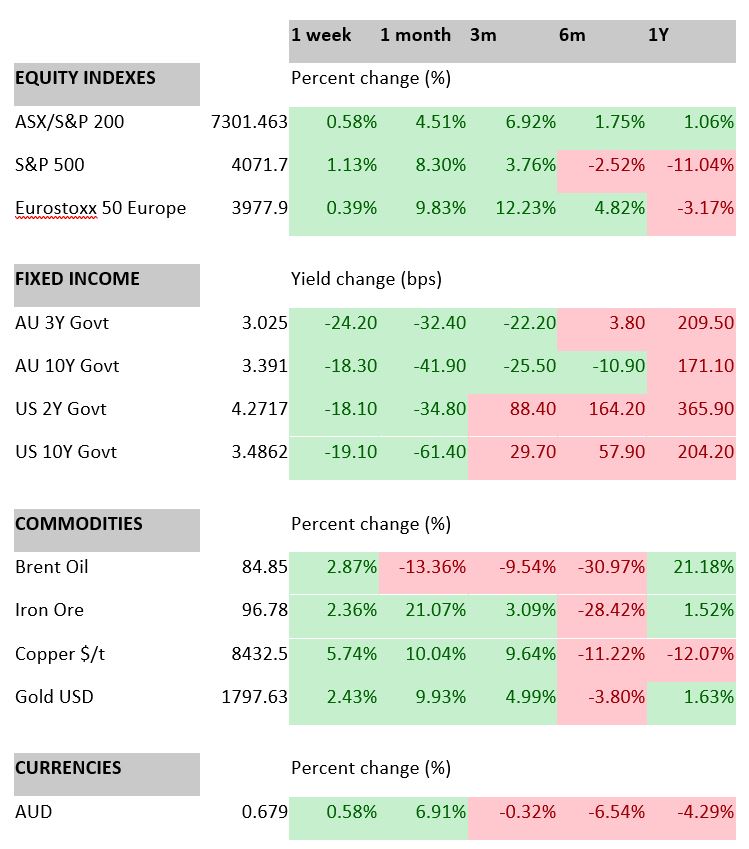

- Australian retail sales disappointed, falling 0.2% compared to consensus expectations for a 0.5% rise.

- Australian inflation fell to 6.9% YoY in October, below estimates for a rise to 7.6%.

- EU preliminary inflation readings were lower than expected with MoM core flat and headline falling 0.1%, while YoY core rose 5% and headline rose 10%.

Inflation figures remain high but have been surprising to the downside compared to consensus over the past few weeks, helping to support markets as yields move lower as the probability of central banks (predominantly the US Fed) moderating the pace of hikes, and therefore, the probability of a ‘soft landing’, rises. - US consumer confidence and personal spending were in-line with expectations as consumers remain solid, with spending growing 0.8% MoM, despite weakening sentiment.

- US job openings came in below expectations. They remain at elevated levels but are trending lower.

- US employment data was stronger than expected with 263,000 jobs added and wages growing 0.6% MoM or 5.1% YoY. The strong labour market remains a risk for markets as the Fed may be forced to hike further and a soft landing becomes harder to achieve.

- US Q3 GDP rose 2.9%, above consensus expectations for 2.7%

- US PCE inflation were in-line with consensus at 6% YoY and 5% core YoY. These are consistent with the slowdown in CPI figures.

- China PMIs were weaker than consensus, with Manufacturing falling to 48 and Non-Manufacturing falling to 46.7. This reflects the surge in COVID infections and restrictions, though the recent shift in government policy seems to be towards moderating the zero-COVID strategy which could lead to a sharp rebound in activity in the coming months.

Key releases for the week ahead

- ANZ job ads

- RBA policy meeting – 0.25% hike expected

- Australian Q3 GDP

- US ISM Non-manufacturing PMI

- US CPI

- EU Q3 GDP

- China Caixin Services PMI

- China trade data

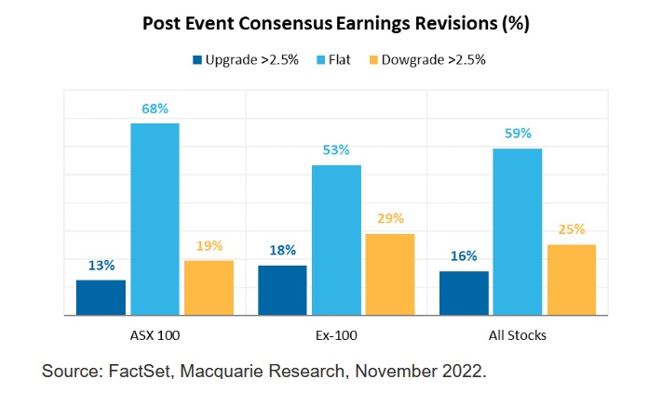

Chart of the week

The domestic AGM season brought more downgrades than upgrades despite the strong returns over November. We remain cautious on the outlook as further downgrades may be forthcoming as the economy slows while companies still have to contend with the headwinds of higher interest costs and inflationary pressures.

–

Monday 05 December 2022, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.