Over the past month, inflation fears have given way to recession fears. Equities failed to build on the previous week’s rebound and fell again but bonds managed to rally again as yields fell sharply on speculation that central banks would have to shift back to cutting rates again in 2023. The MSCI World fell 1.9% as the U.S. S&P 500 fell 2.2%. Emerging markets performed better as China’s Shanghai Composite bucked the trend with a 1.1% rise.

The S&P/ASX 200 was a relative outperformer, falling 0.4% for the week. Tech (-2.1%) remained an underperformer while Telecoms (-2.2%) and Materials (-1.7%) also fared poorly. Defensive sectors fared better with Utilities (+2.6%) and Staples (+0.7%) faring relatively well. Industrials (+1.9%) benefitted from a rally in Brambles (BXB) as the company announced they would not be proceeding with an investment in plastic pallets. The investment would have meant another large capex commitment and was expected to be dilutive to group returns.

Bond yields were sharply lower with the Australian 10-year yield ending the week below 3.6% while the U.S. 10-year yield fell below 2.9% as U.S. consumer confidence and personal spending data came in weaker than expected. Commodity prices were lower as the weaker economic data hurt sentiment with Brent oil prices falling back to USD111.62 per barrel while iron ore fell 11.8% to USD114.45 per tonne.

While U.S. and European economic data were weaker than expected, Australian and Chinese data were better. Domestic retail sales grew by 0.9% while manufacturing survey results rose from the previous month’s readings, indicating an improvement in activity. China’s manufacturing and non-manufacturing purchasing manager indices (PMIs) returned to expansionary territory after mobility restrictions were eased.

This week, the Reserve Bank of Australia will headline domestic news, with another 0.5% rate hike expected. U.S. employment data will also be closely watched alongside global services PMI readings. China also releases its producer price index (PPI) which could provide some clues on the inflation outlook.

Earnings start to roll

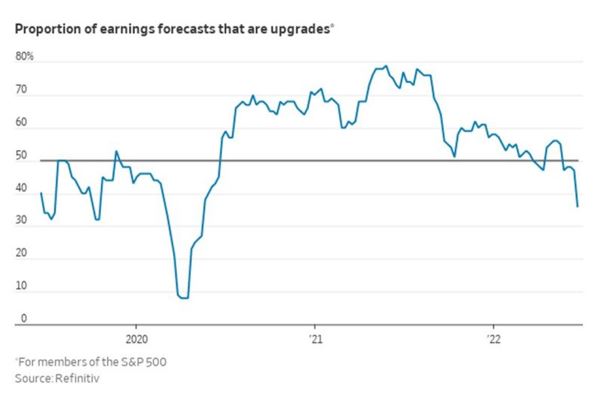

At the end of May, we wrote about remaining cautious despite a sharp rally in equities at the time as earnings expectations remained elevated with estimates remaining too optimistic given the backdrop of rising costs and slowing growth. We noted that earnings revisions continued to be higher than the start of the year and negative earnings revisions would likely be yet another headwind for investors in the near term. The chart below shows that we are now starting to see this come through as downgrades have recently outnumbered upgrades.

We remain early in the downgrade cycle and expect that there is further to go for earnings revisions. Historically, earnings can fall over 10% in a slowdown and over 20% in the event of a recession. While equity markets usually find a bottom before earnings expectations bottom out, we think it is still too early to turn more aggressive. Earnings downgrades still look to be in the early stages and valuations do not look cheap yet at the global level. Therefore, we continue to remain conservatively positioned in our models. However, pockets of value are starting to emerge, with certain regions like Australia and China trading well below historical multiples. We continue to retain an overweight to domestic equities as a result, while our international equity portfolio has an overweight to Asian equities relative to the benchmark, driven by where the managers in our portfolio see opportunities.

–

Tuesday 05 July 2022, 9am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.