Key economic releases last week

- Australia’s Fair Work Commission increased the national minimum wage by 8.6% to $23.23/hr and a lower but still above consensus 5.75% increase on higher award rates.

Markets and economists have been increasing expectations for a further RBA rate hike - The US House and Senate have passed a deal to suspend the US debt ceiling until 2025 with some restraints on government spending.

- US consumer confidence remains resilient as the reading was again positive at 102.3, above the consensus for a reading of 99.

- US employment data was strong again as 339,000 jobs were added compared to expectations for 180,000. Earnings rose slightly less than expected at 0.3% MoM or 4.3% YoY while the unemployment rate moved higher to 3.7% as the participation rate was higher than expected, remaining at 62.6%. Job openings bounced back to 10.1m listings following significant moderation over the past few months.

- US ISM Manufacturing fell to 46.9 compared to the consensus of 47. Employment remained strong while new orders fell, representative of the current economic conundrum of strong employment but weakening outlook.

- EU preliminary inflation data was much better than expected as readings were lower than consensus across the board. Headline CPI rose 6.1% YoY and 0% MoM compared to consensus for 6.3% and 0.6% respectively. Core rose 5.3% YoY and 0.2% MoM compared to consensus for 5.5% and 0.8% respectively.

This represents a marked improvement and should fuel optimism on the inflation front, but the MoM figures need to trend at these levels to allay higher for longer inflation concerns. - China PMIs were weak again as Manufacturing fell deeper into contractionary territory at 48.8. Consensus had expected a rebound to 51.4 into expansionary territory. Non-manufacturing fell but remained solid at 54.5 compared to consensus expectations of 54.9. However, the Caixin Manufacturing PMI, which measures a broader set of companies, came in at 50.9, beating consensus estimates of 50.3.

Key releases for the week ahead

- ANZ job ads

- RBA policy meeting

- Australian Q1 GDP

- US ISM non-manufacturing PMI

- EU preliminary Q1 GDP

- China Caixin services PMI

- China trade data

- China inflation data

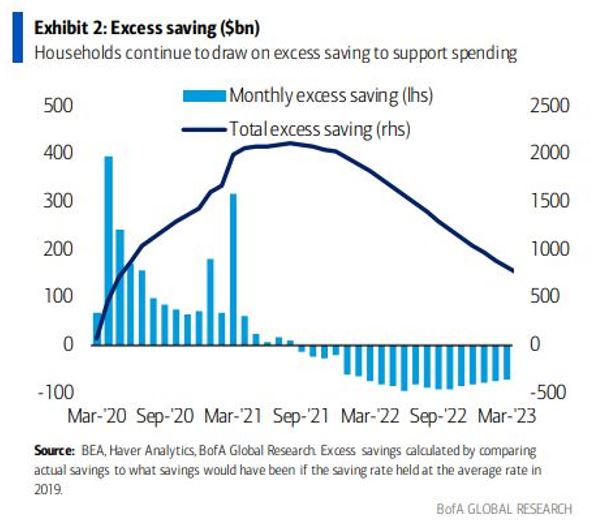

Chart of the week

Consumer spending has been extremely resilient in many major economies despite weak sentiment. This is especially the case in the U.S. where fiscal stimulus was extremely accommodative over the COVID period. The chart above shows the level of excess savings since the start of COVID, with consumers still sitting on cash levels that are well above pre-COVID despite the significant lift in spending over the past couple of years. This could underpin further resilience in the world’s largest economy. While we do see the potential for a soft landing, we continue to consider the outlook for various asset classes on an ongoing basis and currently remain conservatively positioned as we continue to see the balance of risks pointing to the downside based on our investment framework.

–

Monday 05 June 2023, 2pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.