Key economic releases last week

- Domestic retail sales rose 0.6%, ahead of consensus 0.4% as the domestic consumer remains solid.

- US consumer confidence continues to rebound better than expected with the conference board survey reading of 108 above consensus of 104.5

- US PCE was 0.6% MoM and 4.9% YoY, above consensus of 0.5% and 4.7% respectively, with both rising sharply from the previous month’s readings. This is the Fed’s preferred inflation gauge and provides no relief for investors looking for reasons for the Fed to pivot.

- US personal spending remained solid with 0.4% MoM growth but this reading is not inflation adjusted and continues to trail inflation figures which means that real (inflation adjusted) spending has been falling.

- EU inflation continues to be hotter than expected with the latest readings of 1.2% MoM and 4.8% YoY above consensus 0.9% and 4.7% respectively.

- China PMIs were mixed as headline Manufacturing is marginally back in expansion territory at 50.1 while the Caixin reading fell into contraction at 48.1 and the headline Services fell to 50.6.

- BoE intervenes by halting QT and reinitiating QE targeting long term bonds as the pound collapses and long term bond yields spike higher on the back of the new govt’s perceived lack of fiscal discipline.

Key releases for the week ahead

- Aus ANZ job ads

- RBA policy meeting – 0.5% hike expected again

- US employment data

- US, EU PMIs

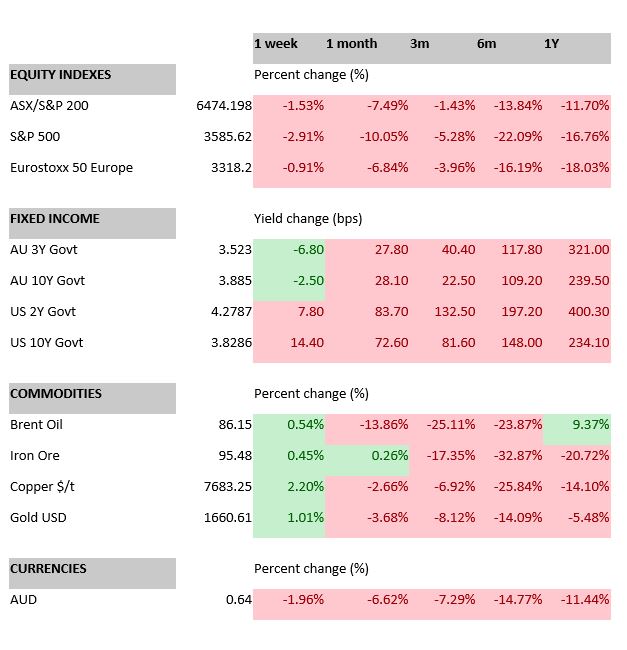

Chart of the week

The Australian consumer continues to look solid as retail sales rose 0.6% in August. Unlike the U.S., retail sales continue to grow even after adjusting for inflation. This supports our view that the domestic economy will likely be more resilient than many other major economies, and also supports our thesis to retain an overweight in domestic equities relative to global equities.

–

Wednesday 05 October 2022, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.