Key economic releases last week

- Australian retail sales fell 3.9% MoM in December, missing estimates for a 0.3% fall.

- US ISM Manufacturing PMI missed estimates, but the non-manufacturing PMI blew past estimates as it rose to 55.2 from last month’s 49.2, driven by a surge in new orders. This indicates that the outlook for services demand remains strong.

- US employment data blew past estimates as payrolls rose by 517k compared to the 185k estimate. Average hourly earnings rose 0.3% MoM, in-line with estimates, while the unemployment rate fell to 3.4%. This strength is supported by continued low levels of initial jobless claims and stronger than expected job openings data.

- US Federal Reserve hikes by 0.25% as expected and sees ongoing rate hikes but Powell noted possibility of rates staying below 5% and expects the US to grow in 2023, spurring hopes for a Goldilocks environment. However, the surge in ISM and employment indicates that the Fed is likely to have to hike more or hold rates higher for longer. With the market pricing in a lower path for rates than the Fed’s outlook, we remain cautious on the sustainability of the recent duration and growth rally.

- China PMIs were largely better than expected, with the headline readings for both manufacturing and non-manufacturing bouncing back above 50 and into expansionary territory.

- ECB hiked rates by 0.5% as expected and signalled further hikes to come.

Key releases for the week ahead

- RBA policy meeting – 0.25% hike to 3.35% expected

- China inflation data

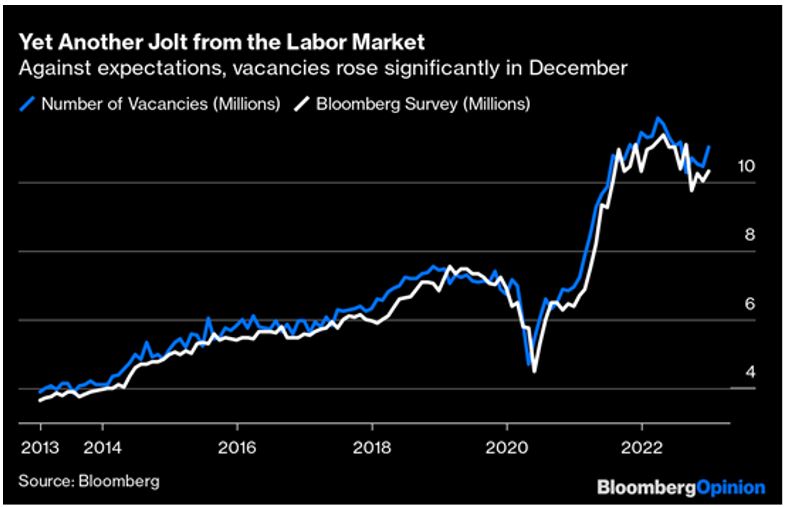

Chart of the week

The latest Job Openings and Labour Turnover Survey (JOLTS) survey showed job vacancies rising again. The strength in job vacancies was supported by US employment data and low levels of initial jobless claims readings which points to a hot US labour market. While US employment costs rose less than forecast in January, there is a risk that the tightness of the labour market will cause wages to start climbing at a faster rate as employers fight for workers in tight industries. The Fed, who reiterated last week that they will be data dependent, will likely have to keep raising rates to combat the tight labour market.

–

Monday 06 February 2023, 2.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.