Key economic releases last week

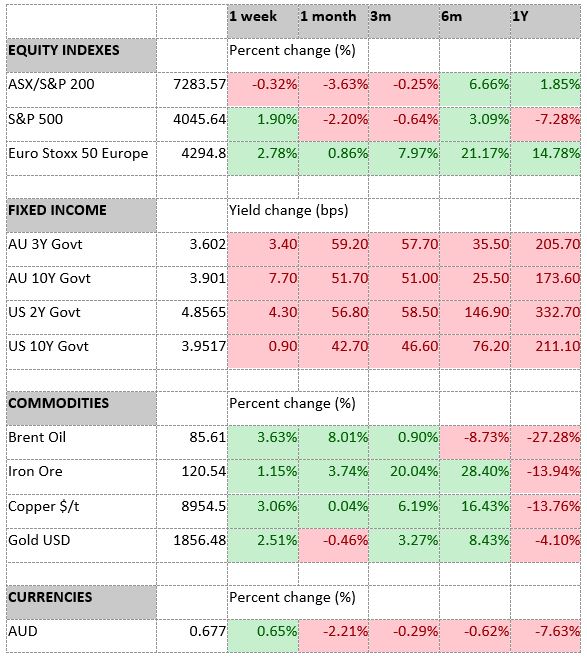

- Retail sales in Australia for January increased by 1.9%, surpassing the expected 1.5%, due to the enduring resilience of consumers.

- The Australian GDP for Q4 increased by 0.5% on a quarterly basis, which was lower than the expected 0.8%. However, revisions to previous periods resulted in the year-on-year growth of 2.7% being in line with expectations.

- US consumer confidence fell to 102.9, below consensus estimates for a 108.5 reading.

- US, EU and Aus manufacturing PMIs were generally stable while services rose and were all in expansionary territory, highlighting the resilience of economies so far despite the sharp rise in interest rates.

- China PMIs for both manufacturing and non-manufacturing were above estimates.

Key releases for the week ahead

- US employment

- China trade data

- China inflation

Chart of the week

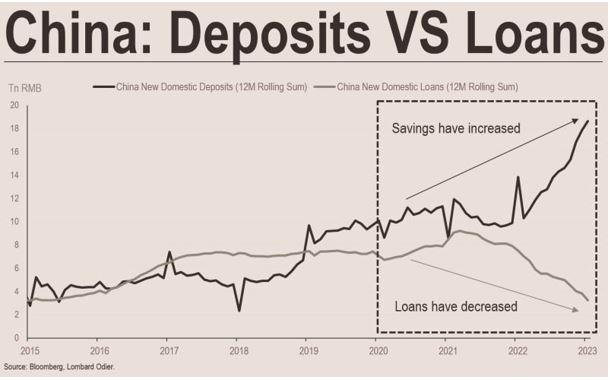

China’s removal of COVID-19 restrictions has opened up opportunities for consumers to shop and spend. The chart below highlights how consumer savings have skyrocketed during the pandemic, as individuals prioritised savings amid economic uncertainty.

The post-pandemic recovery of China relies heavily on boosting domestic consumption, given the weakened demand from the world’s largest importers of Chinese goods, including the United States. The high inflation weighing on global consumers’ purchasing power has been a major contributor to this decline. Furthermore, the United States’ efforts to relocate manufacturing to “friend-shore” locations may exacerbate the problem by further damaging Chinese exports.

With growing confidence in the virus outlook, consumers are expected to spend some of their excess savings. Additionally, early indicators suggest that the housing market has started to stabilise after a decline in 2022. This is likely to enhance consumer confidence and strengthen the Chinese economy’s recovery in 2023.

–

Monday 06 March 2023, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.