Key economic releases last week

- Australian earnings season finished last week. Broadly speaking, demand across most industries remains solid. The Australian consumer is holding up well so far but there is some trade-lower behaviour emerging. Margins are likely to come under pressure as supply chains, input cost inflation and labour availability remain significant issues – this has resulted in less companies issuing guidance or less details in guidance than historical averages

- Australian preliminary retail sales for July rose by 1.3% from the previous month, above the 0.3% consensus estimate. This highlights the resilience of the consumer despite a fall in sentiment.

- US Consumer confidence continues to defy expectations, with the reading rising to 103.2, above the 97.9 consensus estimate.

- Chinese PMIs showed manufacturing continuing to contract, though the reading was slightly better than expected at 49.4 compared to the 49.2 consensus estimate.

- US employment data was again better than expected. Positively, wage growth moderated to 0.3% month-on-month from last month’s 0.5%. Moderating wage growth helps to alleviate fears of a wage price inflation spiral. However, the Federal Reserve has a tough balancing act, and the strength of the employment report supports further tightening in the near term.

Key releases for the week ahead

- The RBA is expected to raise the cash rate by another 0.5% on Tuesday.

- The European Central Bank will also hike rates with consensus expecting a 0.75% increase.

- Chinese data including Services PMI, trade data, and inflation readings.

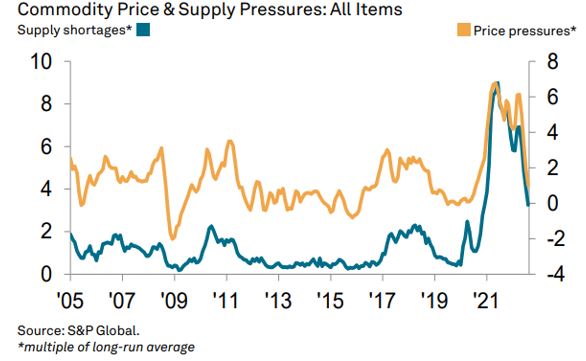

Chart of the week

The chart from S&P Global highlights that price and supply pressures at global manufacturers continue to ease. Price pressures at global manufacturers are now at the lowest levels for the last two years. While this is a positive sign and supports Central Banks in their mission to control inflation, this reading does not capture Services inflation which may prove more difficult to control.

–

Tuesday 06 September 2022, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.