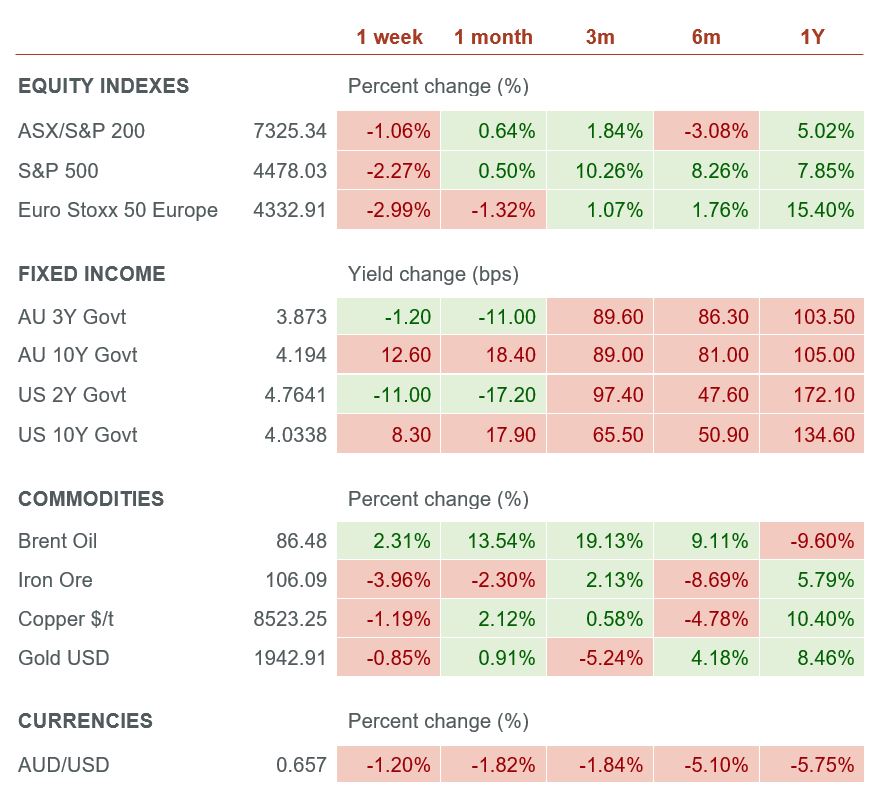

Key economic releases last week

- RBA held rates steady for the second month in a row, adding to speculation that Australia has seen peak rates for this cycle

- US employment data was weaker than expected. Job openings fell more than expected to 9.582m but remains elevated relative to history. Nonfarm payrolls rose 187,000 compared to the 200,000 consensus, though the unemployment rate fell 0.1% to 3.5%.

- EU preliminary inflation was mixed, with the core reading falling 0.1% MoM compared to consensus expectations for -0.5%, while headline fell 0.1% MoM compared to expectations for a 0.3% rise.

- China manufacturing PMI improved but remained in contraction territory at 49.3, non-manufacturing PMI deteriorated to 51.5

- Fitch downgraded US government rating from AAA to AA+, citing the growing debt burden, expected fiscal deterioration and debt ceiling standoffs

Key releases for the week ahead

- ANZ job ads

- Westpac consumer sentiment and NAB business survey

- US inflation data

- China inflation data

- China lending data

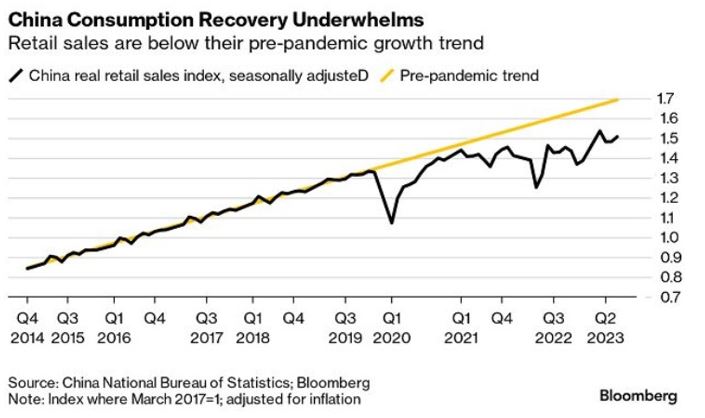

China consumption recovery underwhelms

As a result, China is fighting deflation, unlike the rest of the world which has been fighting inflation. The government has also refused to embark on broad-based stimulus, wary of already high debt levels and issues in certain industries such as property. However, recent rhetoric has shown a greater willingness for fiscal support. If this eventuates and is successful in stimulating demand back towards the long-term trend, this would be supportive of global corporate profits and markets, alongside the global economy. While a global recession remains our base case outlook that has been pushed out to 2024, we think the probability of this occurring has moderated and the success of China’s stimulus could be a factor that would lead us to change this view. Overall, we remain cautious but are constantly challenging our views in light of new information.

–

Monday 07 August 2023, 3pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.