Equity markets were mixed over the last week, with Australia and China rising while the US and Europe fell. The US S&P500 index fell by 1.2%, as investors considered whether the Fed would be able to control inflation without triggering a recession. The Chinese market rose by 2.1%, helped by the country continuing to exit strict lockdowns and further stimulus measures.

The Australian stock market continued its relative outperformance. The ASX200 posted a 0.8% gain for the week, with large caps again outperforming small companies. The Materials sector was the best performer, up 3.8%, led by a Fortescue (FMG), which rose by 9.6%. The worst performer was the Utilities sector, down 4.7%, led by Origin Energy’s (ORG) fall of 9.9% after the company withdrew guidance. Western Areas (WSA) shareholders approved IGO’s acquisition offer of $3.87, with 94% voting in favour. We believe this will be a positive for IGO in the longer term as it extends nickel production life via a new development in WSA’s portfolio. In other news, AGL withdrew its demerger proposal after insufficient shareholder support for the plan.

Bond yields increased substantially over the week despite speculation that the Fed may pause interest rate hikes in September. The US 10-year rose over 20bps to 2.96%, and the Australian 10-year rose to 3.5%. International news likely contributed to this increase with a record high Eurozone inflation (8.1%) and the announcement that the European Union will ban most Russian oil imports by the end of the year. Oil prices rose to over US$120 per barrel despite OPEC agreeing to accelerate production increases from previous plans and boost production by 648,000 barrels a day from the previous 400,000 per day.

Australian Q1 GDP beat expectations at 0.8% quarter-on-quarter and 3.3% YoY. The reading was boosted by inventory growth, but with inventories at high levels, it could be a drag on Q2 GDP. Australian manufacturing and services PMIs showed a slowdown from previous readings, but they remain in expansionary territory.

Healthy US job growth supports a reasonably favourable outlook for the consumer. The economy added 390,000 jobs in May, exceeding consensus expectations of 322,000. The most significant gains were in the leisure and hospitality sector, which supports the view that consumption is shifting back to the services sector. And this potentially offers a respite to goods demand, which are impacted by supply chain issues. US Consumer Confidence is holding up better than expected but remains on a downward trajectory.

The Bank of Canada hiked interest rates by 50bps to 1.5% as expected and signalled further rises are on the way. China’s Purchasing Manager Index readings were better than expected but remained in contraction. China continued to stimulate the local economy by announcing a $120 billion line of credit for infrastructure projects. Further economic recovery is expected as lockdowns ease, and stimulus feeds through the system.

For the week ahead, the RBA is expected to lift interest rates by at least 0.25% on Tuesday. Investors will closely watch US May inflation readings for further evidence that peak inflation is already in. ANZ Job Ads and NAB Business Confidence will give a read on how the local economy is tracking.

Nowhere to hide

It has been a difficult start to the year for investors. Various asset classes, including stocks, bonds, private credit, venture capital, and cryptocurrency, have sold off simultaneously. And excluding commodities, it has felt like there has been nowhere to hide.

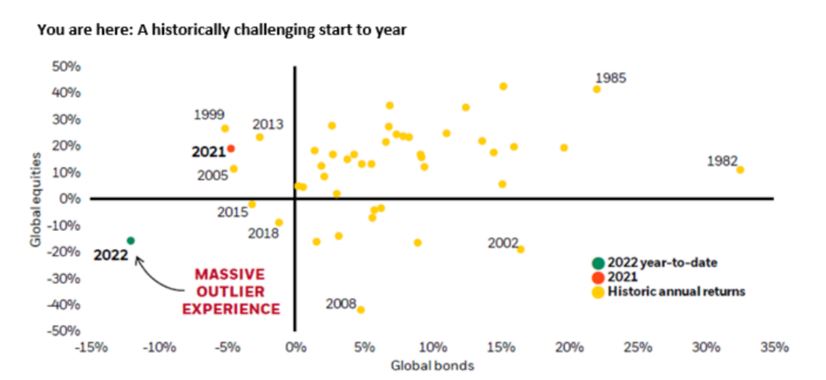

The below chart from BlackRock Investment Institute does an excellent job of demonstrating how challenging it has been in a historical context.

Global equities and global bonds have sold off, with international bonds on track for their worst performance in 40 years. Bonds are traditionally viewed as a defensive asset class because they are less volatile than shares. Many investors include bonds in their portfolios as a source of diversification to help reduce volatility and overall portfolio risk. Looking at the chart, in most years when global equities have sold off, bonds have positive returns, helping to smooth the ride for those in a balanced portfolio.

However, 2022 has proven to be a tricky environment for investors to navigate. Almost all asset classes have been negatively impacted by the same inflation pressures and the associated rise in interest rate expectations. The Australian ASX200 index is one of the few asset classes to stay relatively resilient, benefitting from our heavy exposure to commodities.

Observing the 40 years of data in the chart shows the diversification benefits bonds provide to portfolios. Although these diversification benefits have proven elusive year to date, bonds play a critical role in portfolios, especially with markets expected to remain volatile in the coming months.

–

Tuesday 07 June 2022, 11.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.