Key economic releases last week

- ANZ’s survey of job ads fell 0.3% MoM

- Australian retail sales rose 0.4% MoM, above consensus for 0.3%

- RBA surprised markets by hiking rates 0.25%, with the market pricing only a 10% chance of a hike prior to the meeting. The RBA noted that inflation was past its peak but still too high, with the RBA not expecting inflation to return to the top of the target 2-3% band until mid-2025. Potential for further hikes was also left on the table. This is very hawkish relative to market pricing, repricing may have a bit more room to run, but it is likely that we remain very close to the end of the hiking cycle given that leading employment data is weakening and inflation data is starting to trend lower. We will be watching for the annualised 3m inflation trend to show a sustained move lower towards 3%.

- US, EU, Australian PMIs were mixed as services proved largely resilient while manufacturing remained in contraction for most countries.

- US jobs openings continued to fall while initial jobless claims have been trending at a higher level, signalling a weakening of the jobs market. However, the US unemployment rate fell to 3.4% as payrolls rose by 253,000, more than the 180,000 consensus estimate. Wages rose 0.5% MoM compared to the 0.3% consensus estimate. Wage growth remains well above the level consistent with the Fed’s inflation targets.

- US Federal Reserve hiked rates by 0.25% to 5.25% as expected but left the potential for further hikes open, though it noted that it will watch the impact of further tightening of credit availability. The bank issues and likely sharp tightening of credit standards complicate the Fed’s ability to weaken a stubbornly resilient labour market and inflation. We continue to interpret bond market pricing as a balance between two scenarios; higher for longer, and, a systemic issue sparking sharp cuts. Both have very divergent implications for markets, therefore, we remain broadly diversified.

- ECB hiked rates by 0.25% to 3.75%. Markets continue to price in another ECB rate hike.

- EU inflation data largely came in slightly below expectations but remains at elevated levels. Headline rose in-line with expectations at 7% YoY while core rose 5.6% YoY, slightly below expectations. MoM readings for both were below expectations at 0.7% and 1% respectively.

- China PMIs disappointed after a very strong run of surprises in Chinese economic data over the past 4 months. Manufacturing dipped back into contraction at 49.2 compared to consensus of 51.4, while non-manufacturing remained strong at 56.4 but below consensus of 57.

Key releases for the week ahead

- NAB business confidence and Westpac consumer sentiment surveys

- China exports and imports

- US inflation

- China inflation

- China loans data

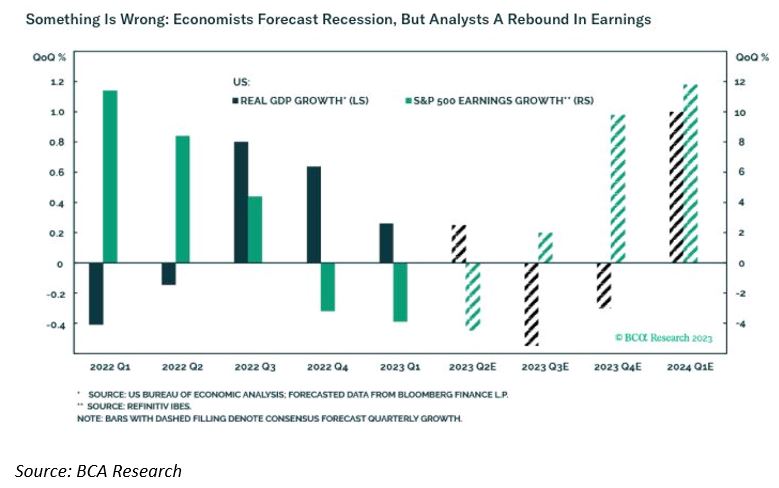

Chart of the week

Last week was a big one for economic data and monetary policy, with the Fed, RBA and ECB all hiking rates again. However, let’s not forget that we are in the midst of US quarterly reporting season. Results have been better than feared, with circa 4 out of 5 of companies beating earnings expectations and three quarters beating revenue expectations so far as we enter the tail end of reporting season. Guidance also seems to be better than expected, with earnings revisions turning positive for future quarters. The question we have been discussing is whether we could be at the end of the downgrade cycle and potentially past the bottom for equities.

There is good reason for optimism, economies have been more resilient than expected, margins have held up at pre-COVID highs and the consumer continues to spend. However, the chart above highlights the disconnect in economic forecasts and earnings. Can earnings rebound strongly in the face of weaker growth over the next three quarters, or are analysts being too optimistic? The outlook for both economy and earnings remain murky, especially given recent bank failures could result in a sharp tightening of credit conditions. Therefore, we continue to remain well-diversified, albeit with a defensive bias.

–

Monday 08 May 2023, 3.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.