Key economic releases last week

- RBA held rates as expected at Michele Bullock’s first meeting in charge.

- China’s PMIs presented a mixed picture. Official readings showed strength, with Manufacturing at 50.2 (in line with consensus expectations) and Non-Manufacturing surpassing expectations at 51.7. However, the Caixin PMIs fell below consensus, with Manufacturing at 50.6 and Services at 50.2. Although all of these figures indicate expansion, they experienced significant declines compared to the previous month.

- US employment data was much better than expected. Average hourly earnings rose 0.2% MoM and 4.2% YoY, 0.1% below consensus. Employment rose by 336,000, well above the 170,000 consensus, driven by private employment. The unemployment rate remained steady at 3.8%. Though job gains were strong, the household survey indicates that this is driven by part time jobs and people holding more than one job, suggesting underlying weakness despite the strong headline figure. This supports the view that the economy could be headed for a soft landing as employment is weakening to alleviate wage pressures, but the unemployment rate remains low.

Key releases for the week ahead

- US CPI and PPI inflation

- Australian Unemployment

- Australian Consumer and Business Confidence

- China Inflation

Charts of the week

US Q3 Earnings properly kicks off this week with major bank reporting their results on Friday. Leading up to this reporting season, expected Earnings Per Share (EPS) for the S&P500 in 2023 have reached their highest point since 2022. This resurgence is primarily driven by rising earnings projections for mega-cap technology companies.

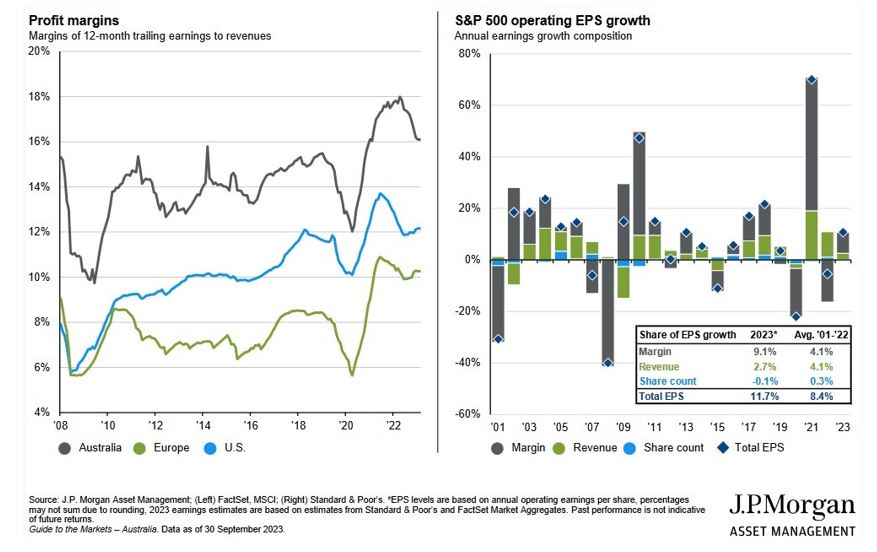

Looking at the charts, on the left, we can see that although profit margins have declined from their COVID-induced highs, they still remain above pre-COVID levels. On the right, it becomes evident that a majority of the expected 2023 S&P500 EPS growth is anticipated to come from margin expansion rather than revenue growth.

Given the backdrop of slowing headline inflation and consumers feeling the impact of tighter financial conditions, we will be watching for early signs that companies are facing challenges in passing on price increases to protect operating margins and offset rising input costs, labour expenses, and debt-related interest costs.

–

Monday 09 October 2023, 3pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.