Key economic releases last week

- RBA held rates at 3.65%, noting that monetary policy operates with a lag though inflation remains high and that some further tightening of monetary policy may well be needed to ensure that inflation returns to target.

- US ISM PMIs were weaker than expected with the manufacturing reading falling to 46.3, below the 47.5 consensus and remaining in contractionary territory, while the non-manufacturing reading fell to 51.2 compared to the 54.5 consensus, though still indicating expansion.

- China Caixin PMIs were mixed, with manufacturing falling to 50 compared to expectations for 51.7, while the non-manufacturing reading of 57.8 was well above the 54.8 consensus.

- US JOLTs fell to 9.931m, below the 10.4m consensus, indicating that job listings are starting to weaken.

- US jobs data showed marginally lower than expected job gains at 236k, while hourly earnings fell to 4.2% YoY and the unemployment rate fell 0.1% to 3.5%.

Key releases for the week ahead

- Westpac consumer sentiment and NAB business survey

- Australian employment data

- US inflation data

- US retail sales

- China inflation data

- China loans and financing data

- US Q1 2023 reporting season kicks off

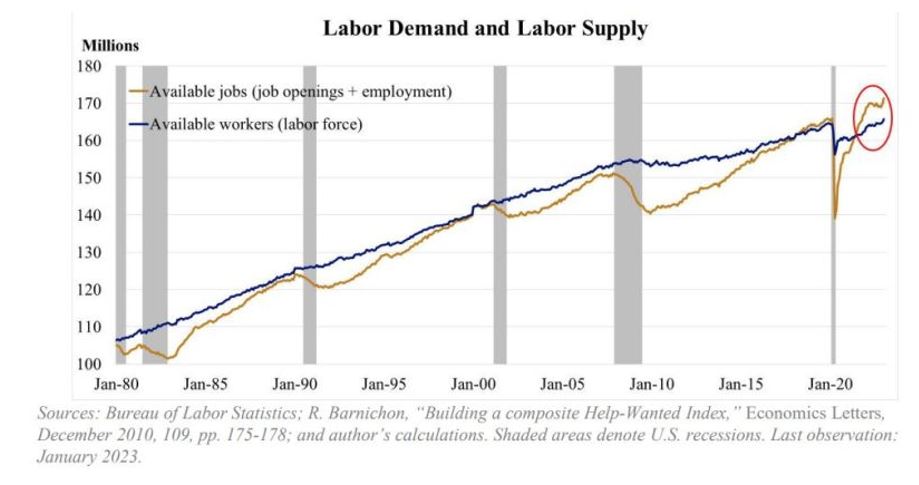

Chart of the week

Last week’s US employment data remained solid, and the chart above illustrates that labour shortages remain an issue. This would keep the pressure on inflation as workers are better positioned for wage negotiations which could end up in a wage-price spiral as core services inflation remains sticky. This can be seen as private market surveys of rents are moving higher again after a period of moderation. However, a recession would help resolve the labour shortage issue from the demand side as available jobs historically fall by a significant amount during recessions.

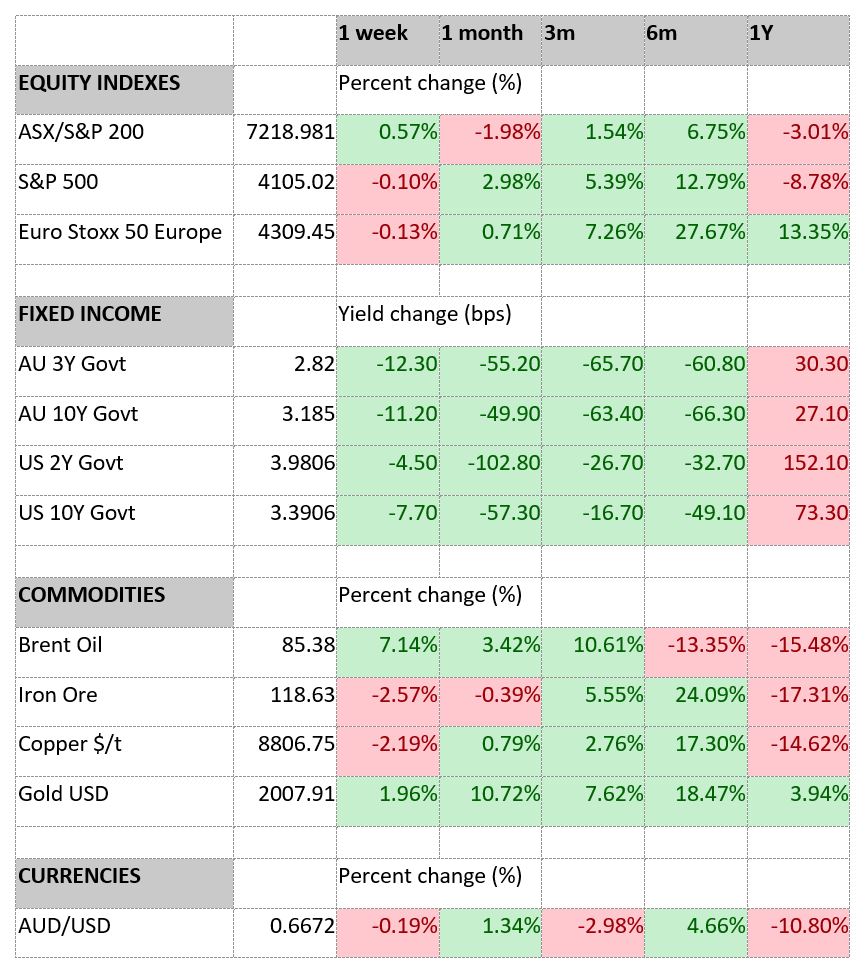

Markets seem to have contrasting views as both bond and equity markets have rallied. Despite the recent pivot in expectations for central bank moves, primarily owing to stress in the banking sector following the collapse of Silicon Valley Bank, Signature Bank and Credit Suisse, sticky inflation makes interest rate cuts unlikely to occur quickly unless systemic issues arise, which would be deeply negative for equities as profit expectations will come under further pressure. Therefore, within liquid markets, we continue to like alternatives that have little correlation to bonds or equities, such as market neutral strategies, or nimble alternatives that can reposition quickly, such as global macro strategies. We also continue to see strong merit in private markets for investors who can handle the illiquidity. These provide differentiated sources of return, helping to diversify portfolios and potentially provide a smoother return profile for investors.

–

Tuesday 11 April 2023, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.