Equities were higher as yields rose and commodities fell. The S&P/ASX 200 rose 2%, driven Afterpay (APT) as it received a takeover offer from U.S. listed Square. Global equities rose 1.2% with cyclicals leading the way as U.S. and European economic data remained strong.

A strong U.S. employment report with the unemployment rate falling from 5.9% to 5.4% drove U.S. bond yields higher alongside the U.S. Dollar, driving broad weakness in commodities as gold and oil fell. Iron ore had already fallen into a bear market earlier in the week as Chinese activity data continued to slow.

Domestically, the Reserve Bank of Australia had its monthly policy meeting, deciding not to change any of its policies despite speculation that there would be a reversal of the decision to trim weekly bond purchases from $5 billion to $4 billion at the end of September.

Strong merger and acquisition activity continued as last week saw OilSearch (OSH) and Santos (STO) agreed on a merger subject to relevant approval. OSH shareholders will receive 0.6275 new STO shares per OSH share if the deal goes ahead. The big headline was the aforementioned APT takeover by Square coming at a 30% premium to APT’s previous closing price via a scrip offer, with shareholders receiving 0.375 Square shares per APT share. As a result, Square will have a secondary listing on the ASX.

Elsewhere, Woodside Petroleum (WPL) updates Scarborough expansion costs to be 5% higher than previous guidance at USD12 billion due to optimisation plans that is expected to drive a 20% increase in offshore processing capacity and a modification to Pluto T1 to allow for the processing increase. WPL expects the internal rate of return for the expansion plans to be above 12% and on this update, we expect this to receive approval to proceed at the final investment decision due later this year.

Earnings are also starting to roll in, with Resmed (RMD) and REA Group (REA) reporting on Friday. RMD reported earnings that were in-line with upgraded expectations and management continues to expect sales to benefit in the order of USD 300-350 million from the Phillips Dreamstation recall. However, this would be subject to its ability to lift production as management noted difficulties with supply of parts.

REA also met expectations but fell as management noted that Sydney lockdowns have led to a 22% fall in listings in the quarter-to-date. Lockdowns continue to provide near-term headwinds but the Australian business continues to strengthen and the market will be looking forward to an expected PropertyGuru listing after REA sold its struggling Asian business for an 18% stake in PropertyGuru.

The domestic earnings season continues to pick up this week, including Suncorp (SUN), Challenger (CGF), Downer (DOW), NAB and Telstra (TLS) of particular interest to our portfolios. On the economic front, investors will be watching U.S. inflation figures closely again whilst Australian employment figures, NAB Business Survey and Westpac Consumer Sentiment survey will help us gauge the impact of recent lockdowns.

Global supply chain issues evident in earnings

As the domestic earnings season kicks off, we can look to the U.S. and European results for insight as both are a couple of weeks ahead. Results aside (earnings growth has been stellar as expected), one key takeaway is that many companies are seeing supply chain issues and expect this to continue.

The shortage of data chips has been heavily discussed over the past few months, but the truth is that supply chain issues are pervasive across industries as global manufacturing remains internationally integrated. We have seen many companies noting rising input costs and flagged increases in the pricing of their products. On Friday, ResMed also flagged that it has excess manufacturing capacity as it has been unable to source certain parts for its devices despite surging demand due to a slip-up from its biggest competitor.

The issue has been driven by the pandemic, with stay-at-home orders and border restrictions driving demand for physical goods as the option to spend on non-physical things like holidays or services dwindle. At the same time, the resurgence of the pandemic in many developing countries has impacted global manufacturing hubs such as Vietnam.

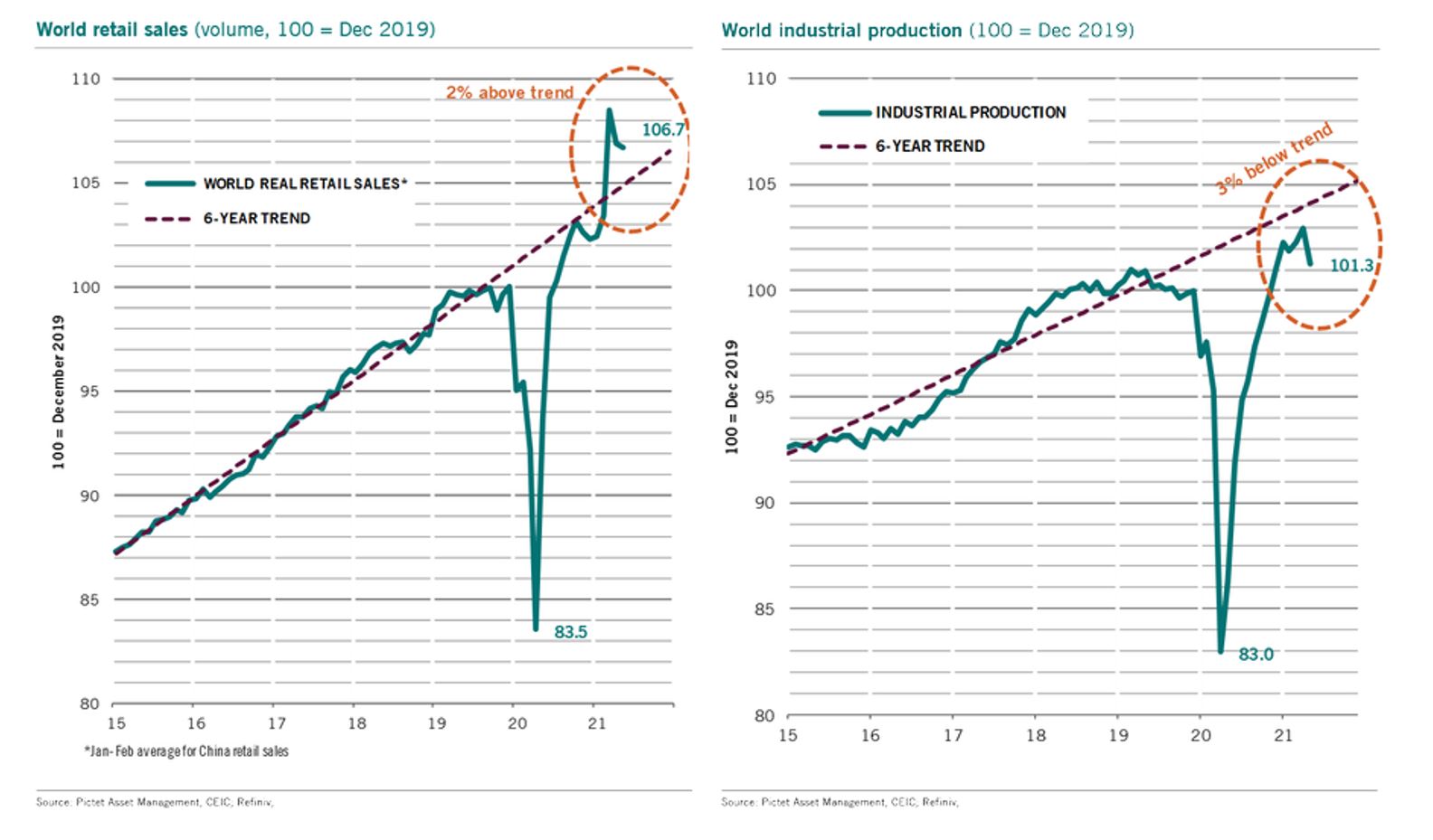

The chart below summarises the driver of supply chain issues, demand for goods that is still 2% above longer-term trends, whilst the industrial production recovery stalls at 3% below trend.

The 5% gap has resulted in supply chain issues and rising producer prices. This will take time to work through the system, especially as the pandemic situation in emerging economies that are responsible for the bulk of global manufacturing remains an issue.

As a result, we expect inflation to remain elevated for some time which should push bond yields higher despite recent worries about growth causing long-term yields to fall since March.

–

Wednesday 11 August 2021, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.