Key economic releases last week

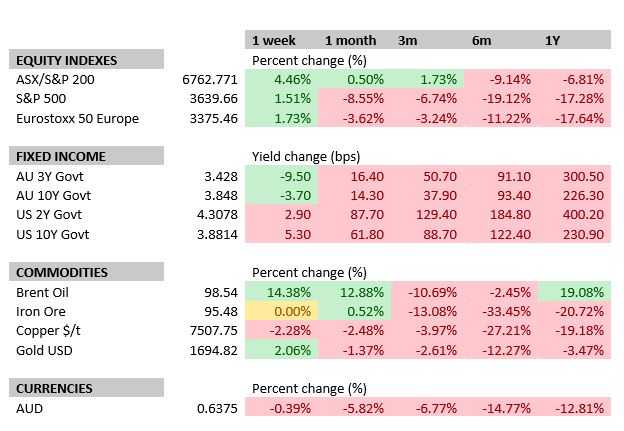

- The US share market was volatile posting its best two-day performance since 2020 before giving up most of the gains over the rest of the week on recession concerns.

- RBA raised rates by 0.25% to 2.6%, defying consensus expectations of 0.5% and going against the hawkishness of the US Federal Reserve. This led to a slew of downgraded expectations for future hikes and the terminal rate.

- Aus Purchasing Manager Index (PMI) readings continue to indicate a resilient domestic economy with both Manufacturing and Services remaining in expansionary territory.

- US employment data remains stronger than expected as the US added 263k jobs and the unemployment rate fell to 3.5% from 3.7%, helped by a 0.1% fall in the participation rate.

- US PMIs remain largely in expansionary territory and continue to indicate that the US economy remains solid for now despite the sharp rise in rates. However, the impact of monetary policy does historically take some time to filter through to the economy.

- OPEC+ cuts production targets by 2m barrels per day to support oil prices. This was despite the US pressuring OPEC+ to maintain production targets.

Key releases for the week ahead

- US September CPI inflation data

- Australian Consumer Sentiment

- China CPI data

- US Earnings reports including major US investment banks

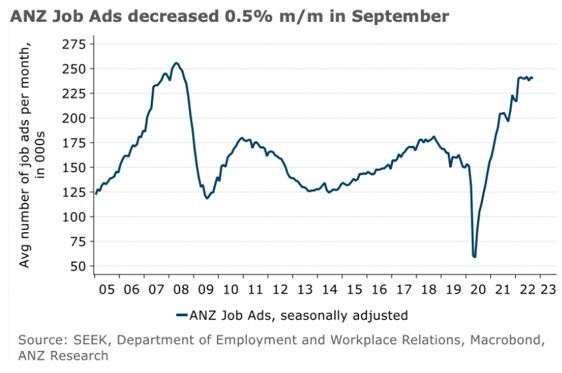

Chart of the week

The ANZ Job Ads tracker fell slightly in September decreasing by 0.5% month-on-month. However, as the chart makes clear job listings are still very elevated compared to listings over the last decade. This points to a tight labour market and helps to explain the resilient domestic consumer.

–

Tuesday 11 October 2022, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.