Key economic releases last week

- The RBA hiked rates by 0.25% to 3.1% as expected and signalled further hikes. The market continues to price in two more rate hikes over 2023 but the range of economic forecasts remains wide.

- Australian Q3 GDP was weaker than expected, growing 0.6% MoM or 5.9% YoY compared to expectations for 0.7% and 6.2% respectively.

- US ISM Non-manufacturing Purchasing Manager Index readings came in at 56.5, much higher than the 53.3 consensus, with underlying components for employment, activity, new orders and prices remaining strong. This indicates that demand for services and services inflation is yet to slow and may put pressure on the Fed to continue hiking rates.

- US PPI was higher than expected with headline rising 0.3% while core rose 0.4% MoM.

- EU Q3 GDP was stronger than expected at 2.3% YoY.

- China Caixin Services PMI was weaker than expected, falling into deeper contraction.

- China trade data was also weaker than expected with exports falling 8.7% and imports falling 10.6%, indicative of a combination of slowing global consumption alongside the impact of strict lockdown measures on domestic consumption and production.

Key releases for the week ahead

- US CPI data

- US Federal Reserve policy meeting and interest rate projections

- US retail sales

- European Central Bank policy meeting

- EU CPI

- Australian NAB business confidence, Westpac consumer sentiment

- Australian employment data, ANZ job ads

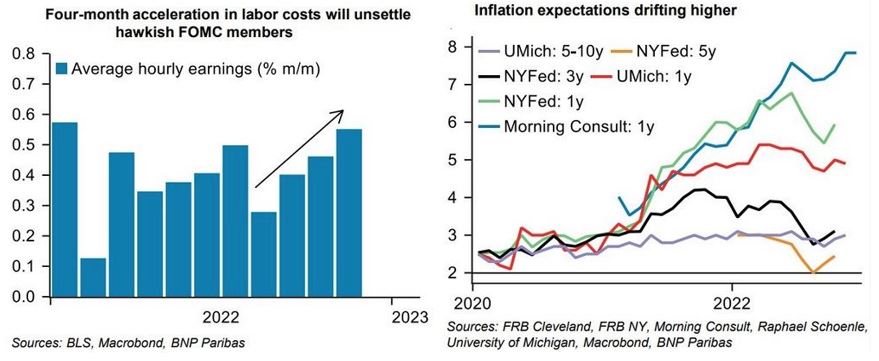

Chart of the week

The charts above show that in the US labour costs, as measured by average hourly earnings, have accelerated over the last four months. Further, longer term inflation expectations have drifted higher. Both data points demonstrate the difficult task the US Fed continues to face in bringing inflation back to their target range. We believe the market may be too optimistic that the Fed is about to shift to a new phase of the hiking cycle and remain cautious about the near-term outlook for risk assets.

–

Wednesday 14 December 2022, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.