Key economic releases last week

- ANZ job ads rose 2% for the month, indicating that the labour market remains strong.

- Australian Q2 GDP grew a solid 3.6% YoY and 0.9% QoQ, largely in-line with consensus.

- RBA raised rates by 0.5% to 2.35%, in-line with consensus estimates, expects to increase rates further over the months ahead but is not on a pre-set path and will be guided by its outlook on inflation and employment. The RBA dropped wording around requiring higher rates to normalise monetary policy. This is indicative of a potential slowing in rate hikes and was confirmed when the RBA noted it still saw the neutral rate as 2.5% leading to some high profile economists moderating their rate hike expectations.

- ECB hiked rates from 0% to 0.75% and indicated that there would be further hikes to come.

- China CPI came in below expectations at -0.1% MoM and 2.5% YoY. The PPI reading also came in below expectations at 2.3% YoY. The PPI reading has historically led global inflation given China’s status as a global manufacturing hub, and the falling figure continues to support easing inflationary pressures for goods.

Key releases for the week ahead

- NAB Business Survey

- Australian employment data

- US inflation figures

- US retail sales

- China fixed asset investment, industrial production and retail sales

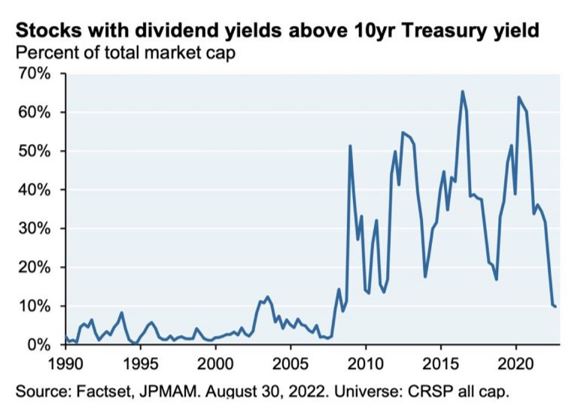

Chart of the week

Prior to the global financial crisis in 2008 and the advent of widespread quantitative easing (QE), it was normal for government bond yields to exceed equity dividend yields. This all changed as QE and negative policy interest rates suppressed bond yields. As central banks wind back extraordinarily easy monetary policies in the effort to combat inflation, we may well see dividend yields fall back below bond yields. However, this should not be cause for concern as the market looks to be normalizing from an unprecedented period of monetary support.

–

Monday 12 September 2022, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.