Key economic releases last week

- ANZ job ads showed resilience as it rose 1.9%

- RBA held rates again at 4.1%, reiterating that it will be data dependent and further hikes may be necessary.

- Australian Q2 GDP was better than expected, rising 0.4% QoQ and 2.1% YoY, above the respective 0.3% and 1.8% consensus. However, productivity as measured by GDP per hour worked and GDP per capita were lower, with a strong jobs market and population growth driven by a surge in migration driving overall growth.

- China exports fell 8.8% and imports fell 7.3% over the last year but both readings were better than consensus as China’s economy continues to struggle.

Key releases for the week ahead

- NAB Business survey, Westpac consumer sentiment survey

- Australian employment data

- US inflation data

- US retail sales

- ECB policy meeting

- Chinese lending data

- Chinese fixed asset investment, industrial production, retail sales and unemployment

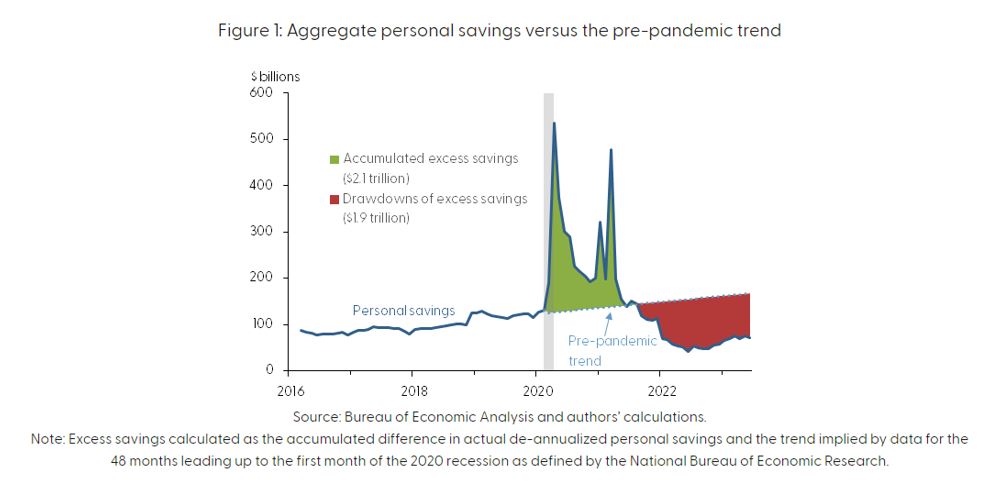

Aggregate personal savings versus the pre-pandemic trend

The above chart from the Federal Reserve Bank of San Francisco demonstrates that the excess savings that US consumers accumulated during the pandemic (US$2.1 trillion) have been drawn down by US$1.9trillion to an estimated US$190billion of aggregate excess savings by June. If the drawdown continues at this pace, excess savings will likely be fully depleted during the third quarter of 2023. While US consumers remain strong in aggregate, the recommencement of US Federal student loan repayments in October, the US labour market showing clear signs of slowing (albeit from a high base), and credit card delinquency rates rising, we will be closely observing US consumption data in the period ahead to see how the consumer holds up against mounting headwinds.

–

Tuesday 14 September 2023, 3.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.