Key economic releases last week

- ANZ job ads rose 0.1% MoM

- RBA hiked rates by 0.25% to 4.1%. Consensus was mixed with markets pricing in a 40% chance of a hike just prior to the meeting. The RBA flagged potential for further rate hikes depending on inflation and economic data.

The fixed mortgage ‘cliff’ over the next few months where a large swathe of fixed rate mortgages expire so we are likely to only start to see the impact of previous hikes start to flow through to consumers in the coming months, keeping us cautious on the outlook. - Australian Q1 GDP rose 0.2% QoQ and 2.3% YoY, missing estimates on both readings by 0.1%.

- US ISM non-manufacturing PMI disappointed with a 50.3 reading compared to consensus estimates for 52.2.

- EU preliminary Q1 GDP shrank 0.1% QoQ compared to consensus for flat growth. It grew 1% YoY compared to consensus expectations for 1.2%.

- China Caixin services PMI rose to 57.1, above consensus estimates that expected a fall to 55.2

- China exports fell by 7.5% YoY, worse than the consensus of -0.4%, while imports fell by 4.5%, better than consensus of -8%.

China exports are usually a bellwether for global growth while imports correlate closer to domestic growth, indicating that global growth may disappoint after showing more resilience than expected while domestic growth may be regaining some traction after a few disappointing months. - China inflation data came in below expectations again as CPI fell 0.2% MoM and the YoY reading rose just 0.2%. PPI fell 4.6% compared to expectations for a fall of 4.3%.

Key releases for the week ahead

- Australia Westpac Consumer Sentiment and NAB Business Sentiment surveys

- Australian employment data

- US inflation data

- US policy meeting and interest rate forecasts

- US retail sales and industrial production

- EU ECB policy meeting

- EU inflation data

- China loans and liquidity data

- China fixed asset investment, industrial production, retail sales and unemployment

Chart of the week

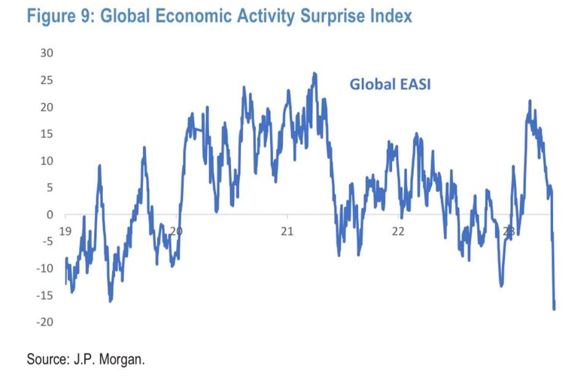

Equities have been running higher alongside bond yields. Usually, this would be accompanied by improving economic data and earnings expectations. However, the current backdrop is mixed. Earnings expectations have indeed improved after a better than expected earnings season, underpinned by NVIDIA blowing guidance expectations out of the water thanks to expectations for AI-driven demand. The economic data has been far more mixed. The chart below shows that global economic surprises have turned sharply lower.

This weakness has been driven by a sharp deterioration in Chinese data, with Europe following suit. US data, arguably the most important for financial markets, has been more positive, though this has also started to turn lower. As a result, we remain cautious in the face of this rally which has been driven by a handful of mega-cap tech names rather than the cyclicals that usually perform better once concerns about economic growth and profits abate.

–

Tuesday 13 June 2023, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.