Key economic releases last week

- ANZ job ads rose 0.4% MoM, rebounding from the previous month’s fall

- The NAB business survey showed some stabilisation as conditions fell marginally to 10 while confidence rebounded to 2. Forward orders and capex intentions have stabilised after deteriorating since the middle of 2022, but labour costs continue to see upward pressure

- US CPI rose 0.2% MoM at both headline and core levels as core rose 4.7% YoY and headline rose 3.2% YoY. Inflation continues to moderate, and the annualised run-rate is now within reach of the Fed’s target. While it is unlikely for cuts to occur quickly, this could support the end to the hiking cycle

- China trade data was weaker than expected again, with exports falling 14.5% YoY and imports falling 12.4% YoY, below the -9.8% and 5.6% respective consensus estimates. These readings also deteriorated sequentially compared to the improvement expected by the consensus

- China CPI rose 0.2% MoM but fell 0.3% YoY, with both readings slightly higher than consensus. PPI continued to fall at -4.4% YoY, below consensus expectations for -4.1%

- China lending data missed expectations as new loans and total social financing missed estimates. China’s economic stimulus continues to disappoint, with little details of stimulus measures thus far

Key releases for the week ahead

- Australian employment data

- US retail sales

- EU preliminary GDP

- EU industrial production

- EU inflation

- China fixed asset investment, industrial production, retail sales

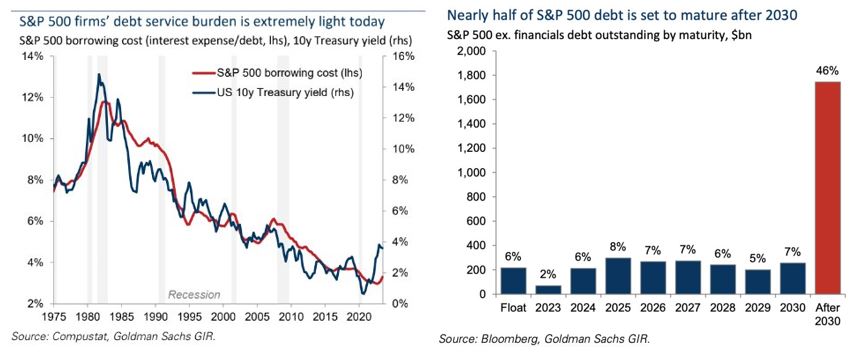

Chart of the week

Aggregate US S&P 500 borrowing costs (interest expense/debt) remain historically low for S&P 500 firms, even though interest rates have surged over the last 18 months. Firms took advantage of the low rates available during in the pandemic to restructure their debt and lock in the low prevailing rates. The average company has remained largely shielded from higher borrowing costs, and this is one of the reasons why the US economy has remained more resilient than most analysts and market commentators had expected. However, eventually these fixed term loans will expire, and companies will have to face the reality of renegotiating their debt and facing higher rates and debt service burdens. Our base case remains that a recession is a likely in the US as the higher rates are digested throughout the economy, but even if a recession can be avoided, higher interest costs going forward will crimp firms’ profitability and will be a valuation headwind.

–

Monday 14 August 2023, 3.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.