Key economic releases last week

- RBA hiked rates by 0.25% to 3.6% as expected. Policy will be data dependent, will look at inflation, spending and labour to determine policy but notes inflation may have peaked. This was a slightly dovish change in the RBA’s communication.

- Fed’s Powell spoke about considering higher rate hikes and higher terminal rates following strong economic data and the rebound in inflation. Markets are now starting to price in a 50bp hike again at the next meeting and 6% terminal rates.

- China trade data continues to be mixed as exports beat consensus but imports missed.

- China inflation data were below consensus at -0.5% MoM and 1% YoY

- China saw better than expected loan growth and liquidity conditions

- US added 311k jobs, above the 205k consensus but wage growth grew 4.6% YoY compared to expectations of 4.7%. The unemployment rate fell 0.2% to 3.6% despite the beat in job adds though, as the participation rate rose 0.1%.

- US Federal Reserve hikes by 0.25% as expected and sees ongoing rate hikes but Powell noted possibility of rates staying below 5% and expects the US to grow in 2023, spurring hopes for a Goldilocks environment

- China PMIs for both manufacturing and non-manufacturing were above estimates as the reopening rebound gathers momentum

Key releases for the week ahead

- Westpac consumer sentiment

- NAB business survey

- Australian employment data

- US inflation

- US retail sales

- EU inflation

- ECB policy meeting

- China fixed asset investment, industrial production, retail sales and unemployment rate

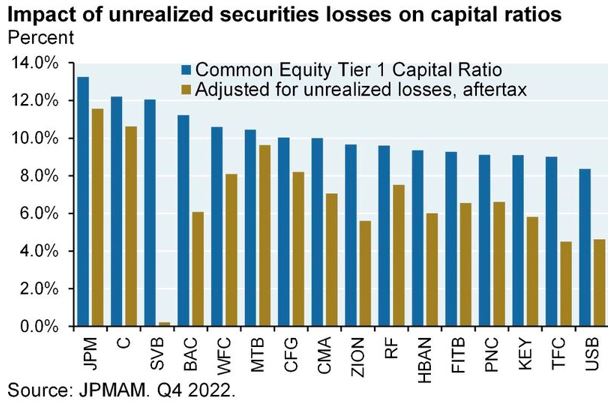

Chart of the week

The collapse of Sillicon Valley Bank (one of the top 20 largest US banks) sparked worries about the banking system, but this is not 2008. Banks regulations are now much stricter on ensuring balance sheet strength and liquidity, while regulators now have a playbook to inject liquidity if required. The chart above shows the issue seems to be poor risk management by SVB, compounded by poor handling by management in trying to remedy the issue, causing a large run on deposits, pushing the bank over the edge. We remain cautious on risk assets, but the SVB failure looks idiosyncratic rather than systematic. Contagion risk will need to be closely monitored.

–

Tuesday 14 March 2023, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.