Key economic releases last week

- NAB business confidence and conditions surprisingly improved in July, remaining at or above the long-term averages.

- Westpac consumer confidence fell another 3% as economic conditions and house price expectations continue to drop.

- Chinese trade data saw stronger than expected exports and weaker than expected imports again, though both grew, signalling a continued recovery. Inflation data was lower than expected, with PPI growing at 4.2% YoY, below the consensus 4.8% and the previous month’s 6.1% reading, indicating easing global inflationary pressures given China remains a global manufacturing hub.

- US CPI of 8.5% YoY, 0.2% below consensus, the first downside surprise since September 2021. The headline reading was helped by lower energy prices. Pleasingly, the core reading also came in 0.2% lower than expected for both the monthly figure which rose 0.3% and yearly figure that rose 5.9%. This was driven by weaker inflation from reopening factors such as vehicles and travel.

Key releases for the week ahead

- Domestic employment data

- US retail sales

- Chinese fixed asset investment, industrial production, retail sales and unemployment

- European GDP and inflation data

- Domestic earnings season ramps up with the likes of BHP and CSL reporting

- US retailers earnings (Walmart, Target, Lowe’s, Home Depot)

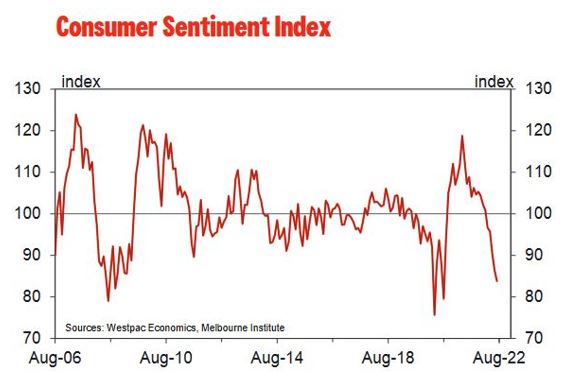

Chart of the week

The Westpac Consumer Sentiment index continues to fall, only the GFC and COVID lockdowns saw worse readings. While consumer spending has remained robust for now, it is likely that poor sentiment will flow through to spending at some point. In turn, the weaker demand would flow through to earnings. While still early in the domestic reporting season, we did not see weakness in the earnings released so far but there are some minor signs of deterioration in forward looking commentary from management.

–

Monday 15 August 2022, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.