Key economic releases last week

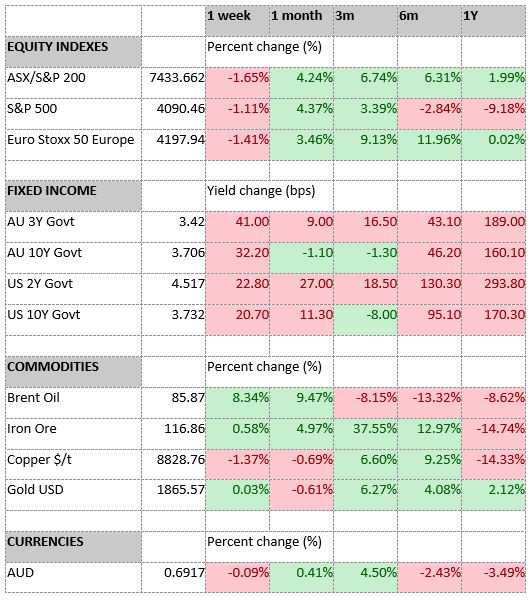

- RBA hiked 0.25% to 3.35% as expected and signalled further hikes to come as it increased its inflation forecasts.

- China inflation data was largely in-line with expectations, rising 0.8% MoM and 2.1% YoY.

- Chinese total social financing, new loans and money supply data rose more than expected, potentially signalling a strong rebound ahead for economic activity.

Key releases for the week ahead

- Westpac Consumer Sentiment, NAB Business Confidence

- Australian employment data

- US inflation data

- US retail sales and industrial production

- EU preliminary Q4 GDP

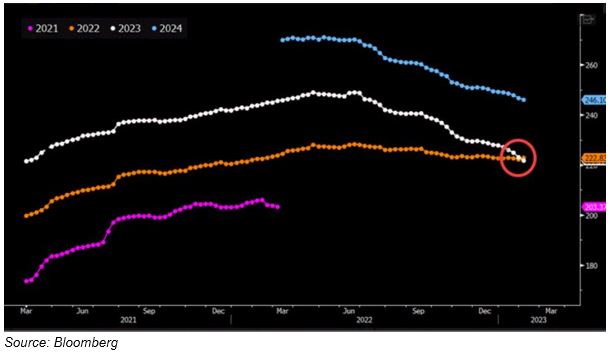

Chart of the week

We are in the latter stages of the US earnings season while the domestic season is just kicking into gear. Although we have seen a blistering start for market returns in 2023, fundamentals remain negative as downgrades continue to flow through. In the US, forward guidance has been significantly poor and year-on-year earnings growth expectations for 2023 have just ticked into negative territory. We remain mindful that there may be further negative earnings revisions as we continue to come off peak margins and strong consumer demand. While markets tend to bottom before the trough in earnings and the economy, we still think markets are under-pricing recession risks in the US. For domestic markets, we should get more insight as we progress through earnings season.

–

Wednesday 15 February 2023, 9am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.