Key economic releases last week

- NAB business confidence slightly improved compared to March but still stayed below the long-term average. Meanwhile, conditions worsened but still stayed above the long-term average.

- China’s exports experienced a growth of 8.5%, surpassing the consensus estimate of 8%. However, imports recorded a decline of 7.9%, which was worse than the consensus estimate of -5%. This decline in imports suggests weaker-than-expected domestic consumption.

- The US Consumer Price Index increased by 0.4% month-on-month for both the core and headline measures, aligning with consensus expectations. The year-on-year rise in the headline measure was 4.9%, slightly below the consensus of 5%. Additionally, the month-on-month core reading, excluding shelter costs, was 0.1%, which further strengthens the possibility of the Federal Reserve pausing. The Producer Price Index readings were also slightly below expectations.

- In China, inflation remains at a weak level, as the Consumer Price Index recorded a minimal year-on-year increase of only 0.1%. On the other hand, the Producer Price Index experienced a YoY decline of 3.6%.

China’s loans data fell short of expectations, with a rise of 11.8% compared to the estimated 12%. Both new loans and total social financing figures were lower than anticipated.

Key releases for the week ahead

- Westpac consumer sentiment survey

- Australian employment data

- US retail sales

- US housing data

- EU inflation data

- China fixed asset investment, industrial production, retail sales and unemployment

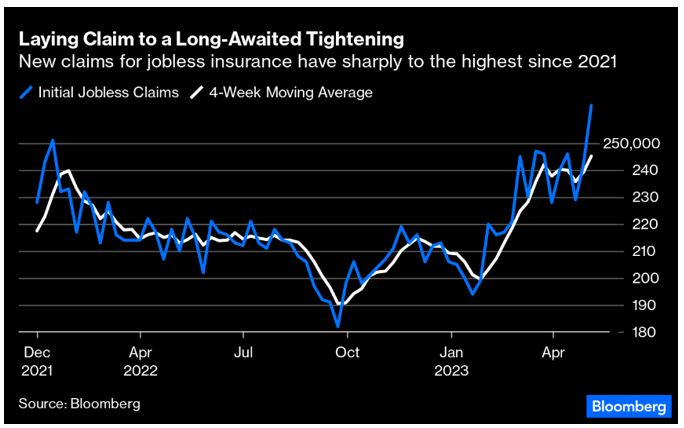

Chart of the week

In the week ending May 6, initial claims for state unemployment benefits rose by 22,000 to reach a seasonally adjusted 264,000. This reading represents the highest level since October 2021. It’s worth noting that weekly figures can be volatile, so experts often rely on the four-week moving average for a more reliable signal. In line with this, the chart above from Bloomberg reveals that the four-week moving average has also climbed to its highest point since late 2021.

Although the US labour market is generally considered healthy from a historical perspective, the upward trajectory of initial jobless claims, combined with recent data indicating a decline in job openings, suggests that the Federal Reserve’s series of rate hikes is beginning to have an impact, exerting a cooling effect on the economy. In light of this employment trend, there is growing support for the argument that the Federal Reserve may choose to pause their rate hikes in the coming months. Such a pause could potentially bolster valuations of risk assets, especially if forthcoming data indicates that the Federal Reserve has not gone too far and inadvertently triggered a significant economic slowdown.

–

Monday 15 May 2023, 2.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.