Key economic releases last week

- Westpac Consumer Sentiment heads lower again, close to record lows as expectations for the economy and family finances fall sharply.

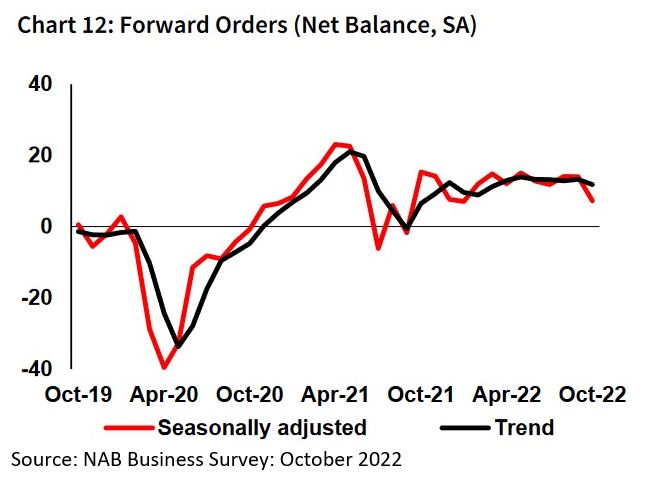

- NAB Business surveys shows sentiment falling further but conditions remain resilient. Positively for inflation, labour costs look to have potentially peaked in Q3 and are moderating based on survey responses.

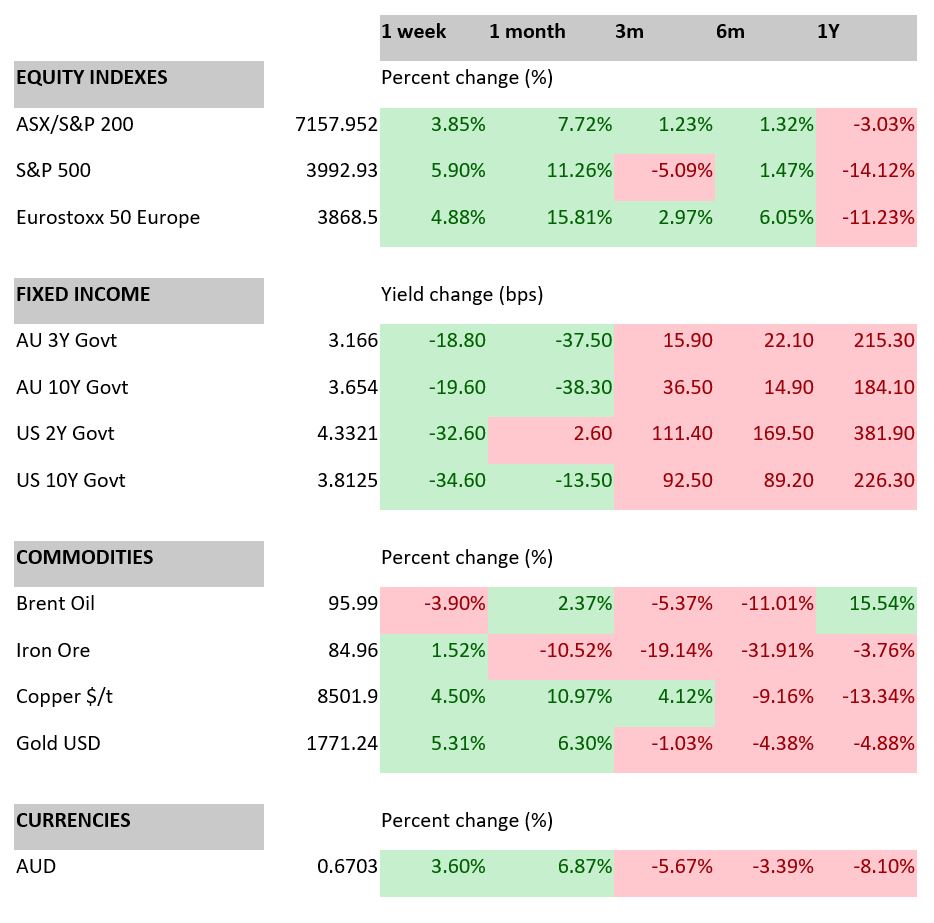

- US inflation readings were better than expected as CPI came in at 0.4% MoM and 7.7% YoY compared to consensus for 0.6% and 8% respectively. Core CPI rose 0.3% MoM and 6.3% YoY compared to consensus for 0.5% and 6.5% respectively. MoM core CPI is the one we are watching closely and the fall to 0.3% is promising. However, one month does not make a trend and we will continue to monitor this closely. The Fed seems to remain more worried about inflation than the economy and is likely to continue hiking until inflation shows an obvious trend that it is slowing to within the 2-3%. We think this requires several consecutive readings of MoM core CPI below 0.3%. Leading indicators are supportive of this trend which should be supportive for markets in the short term, however the next consideration would be to understand whether monetary policy has tightened too far.

- China trade figures were poor, exports fell 0.3% and imports fell 0.7% compared to expectations for +4.3% and +0.1% respectively.

- China inflation continues to weaken with CPI rising just 2.1% YoY and producer price inflation -1.3% YoY.

Key releases for the week ahead

- Australian employment data

- US retail sales and industrial production

- EU inflation data

- China fixed asset investment, industrial production, retail sales and unemployment

Chart of the week

While everyone is focused on a weaker than expected US inflation print last week and hoping for less rate hikes in the near future, it is important to remember that monetary policy acts with a significant lag and that central banks may have already tightened too far. So, while a moderation of inflation and interest rate expectations may drive a rebound, that rebound may be short-lived if earnings continue to collapse on lower demand. The chart above shows forward orders are starting to deteriorate which indicates that demand may be waning, and months of weak consumer sentiment is starting to feed through to spending and the economy.

–

Tuesday 15 November 2022, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.