Happy new year! We hope 2023 will be kinder to investors than 2022 was, though we remain cautious on the outlook at this stage.

Key economic releases last week

- Australian retail sales growth was better than expected, growing 1.4% MoM vs 0.6% consensus, boosted by Black Friday sales and as consumers remained resilient.

- US inflation was in-line for both core (5.7% YoY) and headline (6.5% YoY), continuing to trend lower. The monthly readings were 0.3% for core and -0.1% for headline, as energy prices fell. The MoM readings are now close to the Fed’s target range on an annualised basis as core inflation has been oscillating between 0.2-0.3% over the past few months. However, the annualised rate will take some time to moderate to the target range unless monthly readings turn negative. Therefore, the Fed may continue to lean more hawkish than the market, posing a risk to the early-year rally.

- China inflation was in-line with expectations at 1.8% YoY, while producer prices fell 0.7%, more than the -0.1% expected.

- China trade beat expectations as YoY exports and imports fell less than expected. Hopes are for a quick recovery of economic activity and trade data will be a key indicator.

- China loans and financing growth was weaker than expected. Key will be the next few months as the surge in COVID infections starts to abate and the economic recovery starts to take shape

- US reporting season has kicked off, with some of the major banks reporting solid results thanks to strong trading revenue, though net interest income generally disappointed.

Key releases for the week ahead

- Westpac consumer sentiment

- Aus employment data

- US retail sales

- US PPI

- EU inflation data

- China fixed asset investment, industrial production, retail sales and unemployment

- China GDP

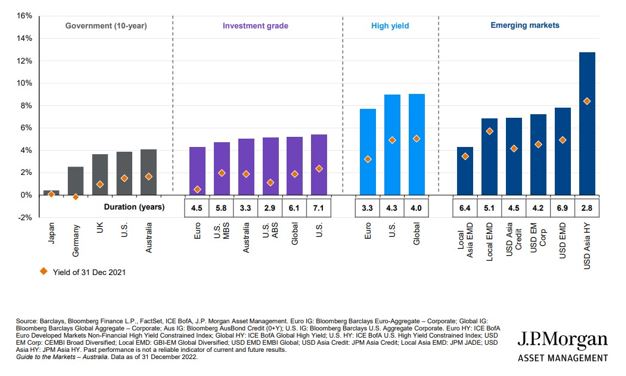

Chart of the week

Last year was a horrid year for fixed income investors, with the Bloomberg Global Aggregate suffering its worst drawdown since the inception of the index. This was driven by rising rates from a low (and some even negative) starting yield and high duration (a measure of sensitivity to interest rates). The chart above shows that yields have now moved much higher compared to the end of 2021, providing better prospective returns and a better cushion against any further rise in yields. We think the safer ends of fixed income are now relatively attractive. While the riskier end now offers some compelling yields, spreads (the difference in yield compared to government bonds) remain below long-term historical averages so we remain cautious in that area of fixed income, especially as the global economy faces growth headwinds.

–

Monday 16 January 2023, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.