Key economic releases last week

- Westpac consumer sentiment and NAB business survey showed some improvement following the RBA’s decision to hold rates last month.

- Australian employment rose by 53k, well above the consensus for 20k. The unemployment rate fell to 3.5%.

- The inflation data in the US was slightly better than expected, with the headline readings lower than anticipated. However, the concern is that the core readings’ annualized monthly run-rate is still considerably higher than the target range, indicating persistent inflation as an issue.

- US retail sales for the month fell by 1% on a month-on-month basis, which was higher than the anticipated figure of -0.4%.

- The inflation data in China was below expectations, as the CPI fell by 0.3% on a month-on-month basis, while the consensus was for a 0.2% increase. Consequently, the year-on-year CPI reading was dragged down to 0.7%. Meanwhile, the Producer Price Index fell by 2.5% YoY, in line with expectations.

- China’s loans and financing data showed growth that was higher than anticipated.

- Chinese trade data was also better than expected, with imports -1.4% YoY compared to estimates for -5% while exports rose 14.8% YoY compared to estimates for -7%.

Key releases for the week ahead

- The preliminary Purchasing Managers’ Index (PMI) data for Australia, the EU, and the US.

- EU inflation data

- US housing data

- China industrial production, retail sales, fixed asset investment, GDP

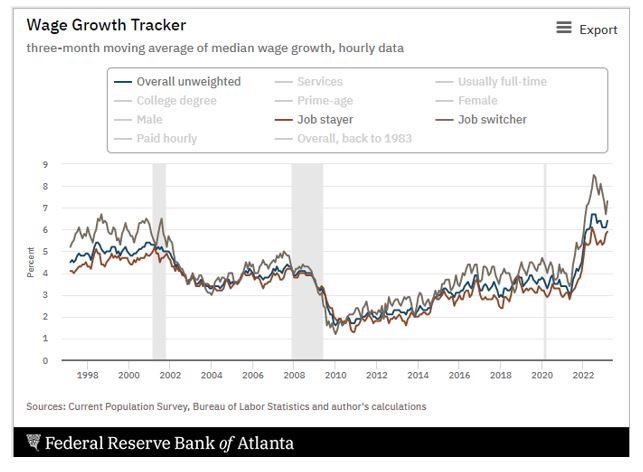

Chart of the week

The Atlanta Fed Wage Growth Tracker is a useful gauge of median wage growth among continuously employed workers in the US. Given its monthly updates, it provides timely information on trends in the labour market, which can shed light on the state of the broader economy. In March, the latest reading showed a reversal of the recent downward trend in wage growth, with both job stayers (red line) and job switchers (brown line) experiencing an increase in wages. Although wage growth is typically viewed as a lagging economic indicator that reflects past labour market conditions, this data strengthens the likelihood of continued rate hikes by the Fed.

–

Tuesday 11 April 2023, 2.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.