Key economic releases last week

- Westpac consumer sentiment survey indicates that consumers remain pessimistic despite some broad based improvement. NAB business survey showed confidence remained stable though still below historical average while conditions weakened but remained above historical average. The survey also pointed to inflation pressures continuing to ease.

- US inflation data was slightly higher than expected as headline CPI grew 0.4% MoM and 3.7% YoY, both 0.1% above consensus. Core CPI was in-line with consensus at 0.3% MoM and 4.1% YoY.

- China lending data was largely weaker than expected as M2 growth and new loan volumes disappointed

- China CPI rose 0% YoY and 0.2% MoM, while PPI fell 2.5% YoY, missing consensus by 0.1% on all three readings.

- China imports continue to be weaker than expected while exports were better than expected, with both readings at -6.2% YoY.

- US Q3 earnings season kicked off with solid reports from major banks.

Key releases for the week ahead

- Australian employment data

- US retail sales

- China GDP

- China fixed asset investment, industrial production, retail sales and unemployment rate

- EU inflation data

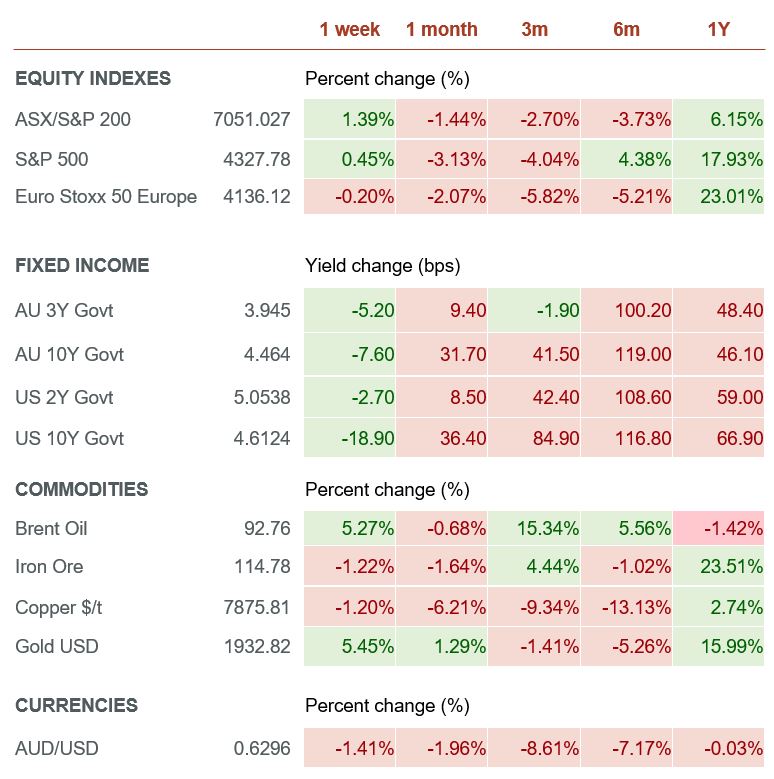

Chart of the week

Equities and bonds have seen weakness recently, with the rise in yields attributed to factors such as higher supply of US Treasuries and worries about the fiscal deficit. Inflation has been falling, at least at the year-on-year level, though last week’s readings were slightly higher than expected. When looking at the month-on-month trend however, there has been a change in the trend, with both Core and Fed Chair Jerome Powell’s cited reading of SuperCore (Core ex Shelter) rising again to a run-rate that implies annual inflation levels above the 2% target.

Source: Bloomberg, Bureau of Labor Statistics

We remain of the view that getting inflation down from 4% to 2% will be much harder, which means continued volatility for bond markets. We continue to watch for MoM Core and SuperCore trends most closely. While we continue to expect that the Fed will be patient in the near-term, especially given the recent rise in yields helping to tighten liquidity, risks are building for the Fed to hike again unless these readings moderate sharply in the next few months.

We still see the current environment as one with elevated levels of uncertainty due to tight monetary policy with the lagged effects still to be understood, especially as pandemic stimulus has cushioned some of the near-term effects. As a result, we remain cautious in our outlook and positioning but are ready to pivot when the outlook becomes clearer.

–

Tuesday 17 October 2023, 2pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.