Key economic releases last week

- Westpac consumer sentiment rose by 2.7% but remains depressed at 81.3 compared to the neutral 100 level. Improvement in expectations for the economy, finances and housing were offset by further deterioration in sentiment of current finances and interest rate expectations.

- NAB business confidence rose from -3 to 0 while conditions were flat at 9.

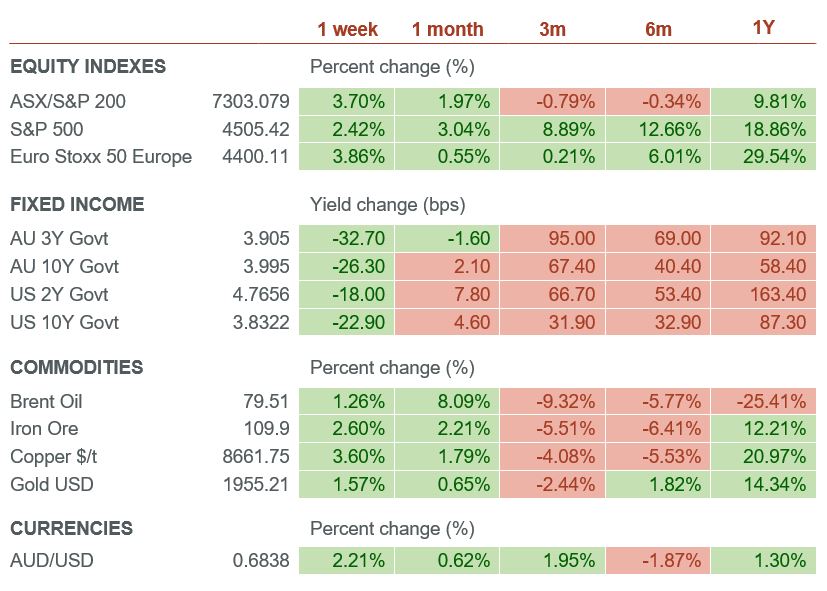

- US CPI fell to 0.2% MoM for both headline and core readings, better than the 0.3% consensus for both. Headline and core PPI rose 0.1% MoM, better than the 0.2% consensus for both.

China inflation data came in lower than expected, with CPI falling 0.2% MoM and 0% YoY while PPI fell 5.4% YoY. - China lending data was better than expected as total social financing rose by 4,220B yuan, more than the 3,000B yuan consensus, while M2 rose 11.3% YoY.

- China trade data missed expectations as imports fell 12.4% YoY and exports fell 6.8%.

- The Fed held rates as expected but projected a further two hikes in 2023 compared to expectations for a potential cut by the end of the year, though cuts are still expected in 2024. The Fed also upgraded its forecast for US GDP to grow 1% in 2023 compared to the 0.4% forecast in March, while unemployment is forecast to rise to 4.1% compared to 4.5% previously. Core inflation is now expected to end the year at 3.9%, up from 3.6%, while headline is expected to be 3.2%, down from 3.3%.

Key releases for the week ahead

- Australian employment data

- US retail sales

- US housing data

- EU inflation data

- China GDP

- China fixed asset investment, industrial production, retail sales and unemployment

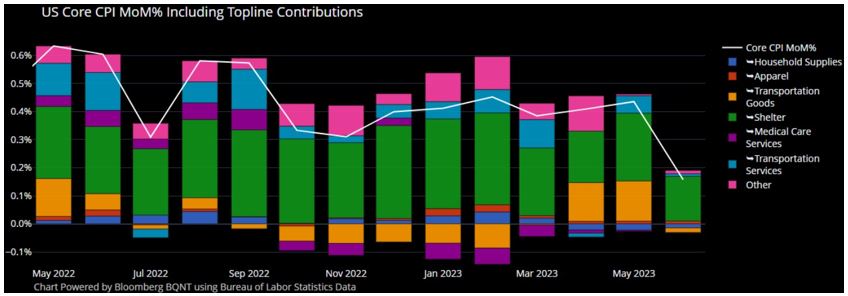

Chart of the week

One monthly reading does not make a trend, but US core CPI was below expectations, rising less than 0.2% and in-line with what is required to get to a 2% annualised inflation target. Core excluding Shelter (now also known as super core), the measure that Federal Reserve Chair Jerome Powell noted they are watching, fell to 0% month-on-month.

Overall, inflation looks to be moderating further and if it can hold this trend, it will now be low enough for the Fed to reach its target. With tougher comparisons, the year-on-year reading is likely to rise in the second half of 2023, but this should be known to the market and the Fed. We believe that we are closer to the end of the rate hiking cycle, and though we expect that rates will have to be held at restrictive levels for some time, we think that this environment will be more supportive for fixed income moving forward.

–

Tuesday 18 July 2023, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.