Key economic releases last week

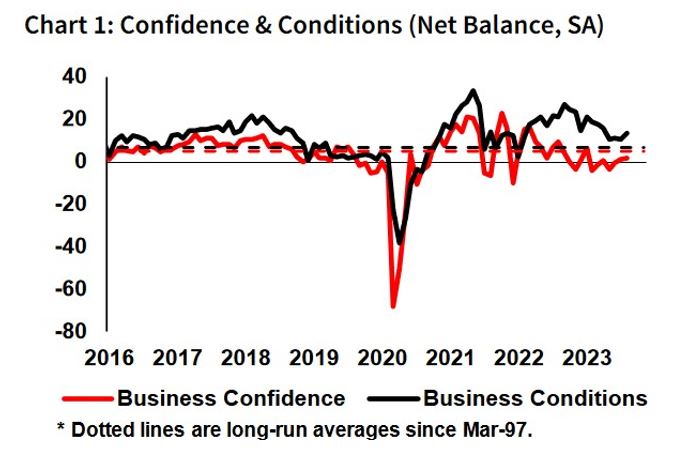

- NAB Business confidence rose marginally to 2, still below long-term averages, while conditions rose to 13, remaining resilient above long-term averages.

- Westpac consumer sentiment fell 1.5% and remains close to historic lows. Current finances and expectations for the economy over the next 5 years deteriorated, partly offset by an improving interest rate outlook helping house price expectations.

- Australian employment rose by 64,900, well above expectations for 23,000 jobs added and rebounding from a surprise loss of 1,400 jobs in the prior month. The unemployment rate held steady at 3.7% as the participation rate rose to 67%. However, the hours worked, underemployment rate and underutilisation rates all indicated a weaker labour market.

A continuation of this slightly weaker labour market but still solid unemployment rate would support the potential for a soft landing with easing pressure on wage growth while the consumer treads water. - US inflation data was marginally above expectations, boosted by rising oil prices. The headline reading rose 0.6% MoM and 3.7% YoY while the core reading rose 0.3% MoM and 4.3% YoY.

We continue to monitor the trend of the MoM core CPI and PCE readings, with a move above 0.2% seen as negative. The Fed may tolerate higher one-off readings but will likely tighten further if there the trending inflation rate moves higher. - US retail sales rose 0.6% for both core and headline readings, better than the 0.4% and 0.2% respective consensus estimates on the back of higher energy prices. Retail sales grew 2.47% YoY but figures are not adjusted for inflation, with real (inflation-adjusted) retail sales falling.

- The ECB hiked rates by 0.25% to a record 4% despite weak economic growth, though ECB President Lagarde hinted potential to pause.

- Chinese lending data showed an improvement as new loans and total social financing rose more than expected. After a weak period, better lending data indicate that stimulus measures may be starting to take hold but more evidence will be required to gain confidence in a Chinese economic rebound.

- Chinese fixed asset investment of 3.2% marginally missed consensus for 3.3% but industrial production (4.5% vs 4%), retail sales (4.6% vs 3%) and unemployment rate (5.2% vs 5.3%) all beat estimates.

- China cut its Reserve Requirement Ratio for banks by 0.25% again in the effort to further boost liquidity and lending

Key releases for the week ahead

- US Fed policy meeting and interest rate projections

- EU inflation data

- US, EU, Australian preliminary PMI readings

Chart of the week

The NAB business survey showed business conditions improved and remained above long-run averages. While confidence is still below the historical average, it also improved and has shown a trend of stabilisation over the past few months.

The domestic economy has been resilient to the sharp rise in interest rates despite imbalances and issues in pockets of activity over the last year. The stabilisation in current conditions highlights this resilience while the stabilisation and improvement in business confidence points to a more positive outlook.

As it stands, a soft landing for the domestic economy looks likely, while a potential recovery in China’s economy could provide a boost for Australia. However, this represents a conundrum for the Reserve Bank of Australia and investors. Inflation, though slowing, remains too high. The outlook for soft landing or no landing for the economy is likely to lead to elevated inflation and may force the RBA to resume hiking, tripping up investment markets which now expect to be at or one hike away from peak interest rates. This would represent a major risk to the recovery in markets. Therefore, we remain cautiously invested, advocating for an overweight to cash and diversification into uncorrelated sources of returns.

–

Monday 18 September 2023, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.