This will be our final update for 2022 and we will resume on 16 January 2023. Thanks for reading and best wishes for the holiday season, see you next year!

Key economic releases last week

- NAB business survey indicates that business conditions remain solid but confidence continues to deteriorate and is now below long run averages.

- Westpac consumer sentiment rebounded 3% but remains near historical lows. Near term expectations continue to deteriorate but future expectations are improving as the bulk of the tightening cycle now looks behind us.

- Australian employment data was much stronger than expected, with 64,000 jobs added relative to expectations for 19,000. The unemployment rate remained at 3.4% as the participation rate rose 0.3% to 66.8%. This supports the case for the RBA to continue hiking rates, with the market pricing another 2-3 hikes in 2023.

- US CPI data was better than expected as the core and headline MoM rose 0.2% and 0.1% respectively.

- US Federal Reserve (Fed) hiked rates by 0.5% to the 4-4.5% range as widely expected. The Fed also released its interest rate expectations, with the 2023 median rising from 4.6% to 5.1% before 1% worth of cuts being expected in 2024 and another 1% in 2025. This is significantly higher than market implied expectations, with market expectations having come down sharply after the CPI report that was released a day prior.

- US retail sales was weaker than expected with headline -0.6% MoM compared to -0.1% expected, and core -0.2% compared to 0.2% expected. US consumers have been resilient despite collapsing confidence for most of this year but are starting to show some weakness.

- European Central Bank hiked rates by 0.5% as expected, bringing the main rate to 2.5%. The ECB also announced the start of quantitative tightening in 2023 at EUR15b/month.

- EU CPI was largely in-line with expectations as MoM readings fell to 0% for Core and -0.1% for headline.

- China fixed asset investment rose 5.3% YoY, industrial production grew 2.2% YoY and retail sales fell 5.9% YoY. All three readings were below expectations.

- Preliminary PMIs show that Australia and the US continue to weaken faster than expectations and are largely in contractionary territory. Meanwhile, European readings have been surprisingly resilient over the past few months, though still in contractionary territory.

Key releases for the week ahead

- US consumer confidence and personal spending

- US PCE

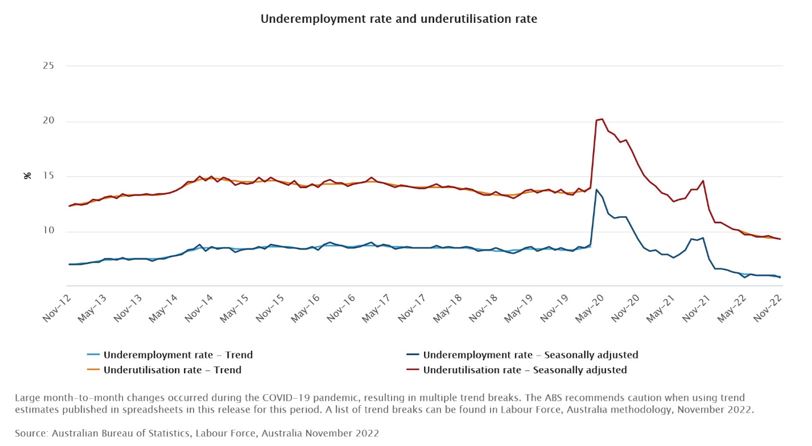

Chart of the week

Given our conservative positioning, I was going to include a bleaker chart and commentary. However, with the festive season coming up, I thought that something more cheerful would be appropriate. The local jobs market remains significantly strong as the unemployment rate remained at record lows. Unlike many other developed markets where there has been a disruption to the labour supply due to disrupted migration or early retirements, this comes amid increased participation rate and number of employed people compared to pre-COVID levels. The chart above shows that underlying measures are strong as well, indicating a very healthy domestic jobs market overall.

–

Monday 19 December 2022, 2.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.