Key economic releases last week

- Australia Westpac Consumer Sentiment rose marginally by 0.2%, remaining near historical lows. NAB Business Sentiment survey showed deterioration for both confidence and conditions.

- Australian employment data was far stronger than expected with 75,900 jobs added compared to the 15,000 expected. Of this, 61,700 were full-time jobs. The unemployment rate fell 0.1% to 3.6% despite the participation rate ticking 0.2% higher to 66.9%.

This is likely to continue to pressure the RBA to consider further hikes as inflation remains too high and employment remains solid. - US headline CPI rose 0.1% MoM or 4% YoY, slightly below expectations for 0.2% and 4.1% respectively. This was driven by lower energy prices following a sharp slide in oil prices. Core CPI was in-line with consensus at 0.4% MoM and 5.3% YoY.

The MoM run-rate for Core CPI remains inconsistent with the Fed’s 2% target, keeping it difficult for the Fed to stop hiking given the lack of improvement. Weakening leading economic indicators does give the case for a pause to allow tighter monetary policy to work its way through but hopes for near-term rate cuts are fading.

- The Fed held rates as expected but projected a further two hikes in 2023 compared to expectations for a potential cut by the end of the year, though cuts are still expected in 2024. The Fed also upgraded its forecast for US GDP to grow 1% in 2023 compared to the 0.4% forecast in March, while unemployment is forecast to rise to 4.1% compared to 4.5% previously. Core inflation is now expected to end the year at 3.9%, up from 3.6%, while headline is expected to be 3.2%, down from 3.3%.

Although the projections are hawkish, markets are pricing the path to be more likely one more hike and done for the rest of 2023 despite Powell suggesting cuts could be a couple of years out. - US retail sales rose a better than expected 0.3% MoM, though the core reading was in-line with expectations at 0.1%. Industrial production fell 0.2% MoM, missing expectations for a 0.1% rise.

- The ECB hiked rates by 0.25% again to 4%, with the deposit rate rising to 3.5%.

- EU inflation rose in-line with expectations at 6.1% YoY for the headline and 5.3% for core.

- China loans and liquidity data disappointed, with new loans and total social financing rising less than consensus expectations. The PBoC cut the 7-day repo rate and medium term lending facility by 0.1% each to 1.9% and 2.65% respectively, in a sign that China is likely to stimulate further after a sharp slowdown in its economy over the past few months.

- China economic data disappointed across the board. Fixed asset investment rose 4% compared to expectations for 4.4%, industrial production grew 3.5% compared to the 3.8% consensus, and retail sales grew 12.7% compared to the 13.7% consensus. The unemployment rate was steady at 5.2%.

Key releases for the week ahead

- US housing data

- US and EU preliminary PMIs

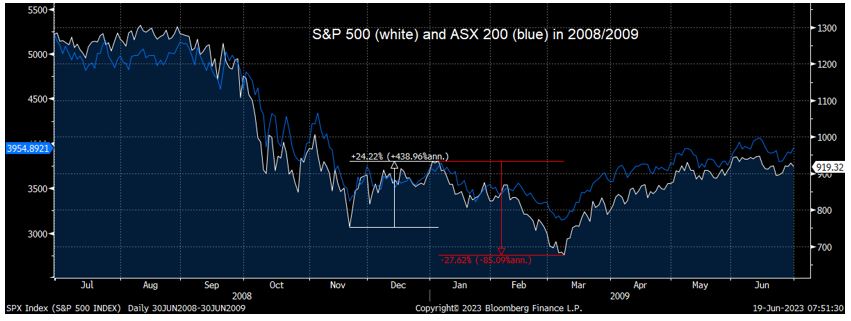

Chart of the week

The risk-on rally continues with investors questioning if this is just the start of a new bull market. However, as we have pointed out last week, economic data has been weakening rather than showing signs of rebounding or bottoming. Last week, the US Federal Reserve and European Central Bank followed the Reserve Bank of Australia in noting that despite market expectations, further rate hikes are likely to be necessary to combat resilient inflation. In Australia, a renewed hiking cycle remains a concern as the bulk of fixed-rate mortgages roll over in the coming months, resulting in a significant lift to mortgage expenses. Sentiment across business and consumers have already been weak for some time but other economic data are starting to deteriorate more markedly.

Resilient and solid labour markets have been at odds with other economic data, however, employment is always the last shoe to drop and could have been exacerbated by the impact of post-COVID normalisation. There are some signs of weakening at the edges, such as job ads or US unemployment claims, but as we saw last week in Australia, hard data such as the unemployment rate or number of employed people remains much better than expected.

The example above is an extreme from 2008. While a 20% gain from the bottom is a technical bull market, it does not necessarily mean the way forward is all clear. Bear markets have historically seen multiple rallies of 20% or more within a greater downtrend.

With positioning and sentiment still not at extremes, this rally could persist in the near-term, supported by resilient employment. However, weakening economic growth is at odds with recent optimism in earnings and the strength of the labour market. As a result, our medium-term outlook remains one of caution, though time will tell whether this is a bear trap or a bull trap.

–

Monday 19 June 2023, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.