Key economic releases last week

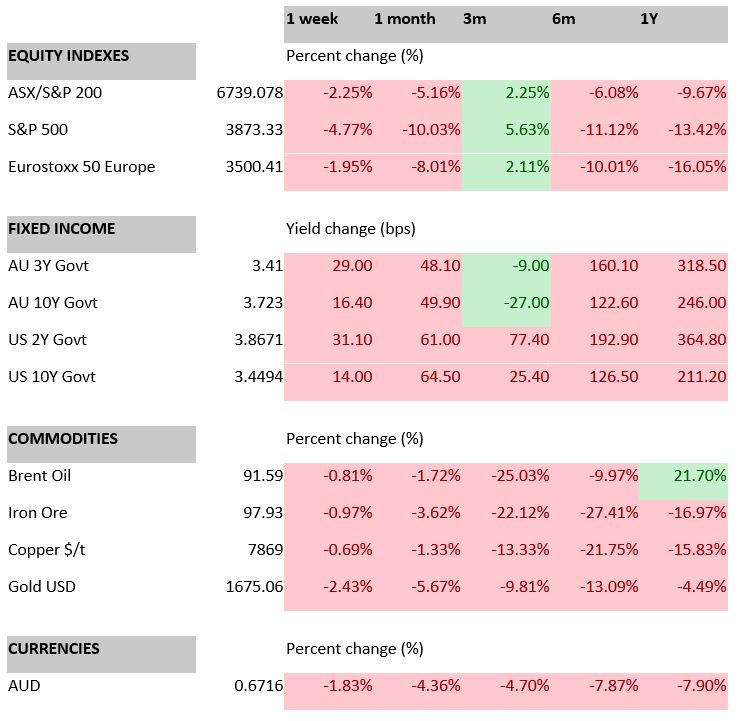

- US inflation figures were higher than expected with core inflation rising 0.6% MoM compared to the 0.3% consensus. Headline inflation was 8.3% YoY versus the 8.1% consensus. Worryingly, stickier components such as housing and medical costs are driving the readings higher. Share markets across the globe fell sharply in response, and bond yields rose.

- Australia added 33.5k jobs, slightly below the consensus estimate of 35k. The participation rate rose by 0.2% to 66.6%, driving the unemployment rate up 0.1% to 3.5%. Overall, still a solid report.

- Westpac Consumer Sentiment rebounded 3.9% but remains near historic lows at 84.4. The bounce was driven by an improvement in expectations for economic conditions over the next 12 months.

- US retail sales remained solid, rising 0.3% MoM and 9.1% YoY. Consumers remain resilient and may continue to do so if the labour market remains tight.

- China fixed asset investment rose 5.8%, industrial production rose 4.2% and retail sales rose 5.4% in August compared to the previous year. These readings were all above consensus estimates as China continues to balance stimulus with rolling lockdowns.

Key releases for the week ahead

- The Fed is expected to hike rates by another 0.75%.

- RBA minutes from last meeting

- Bank of England likely to hike by 0.5%.

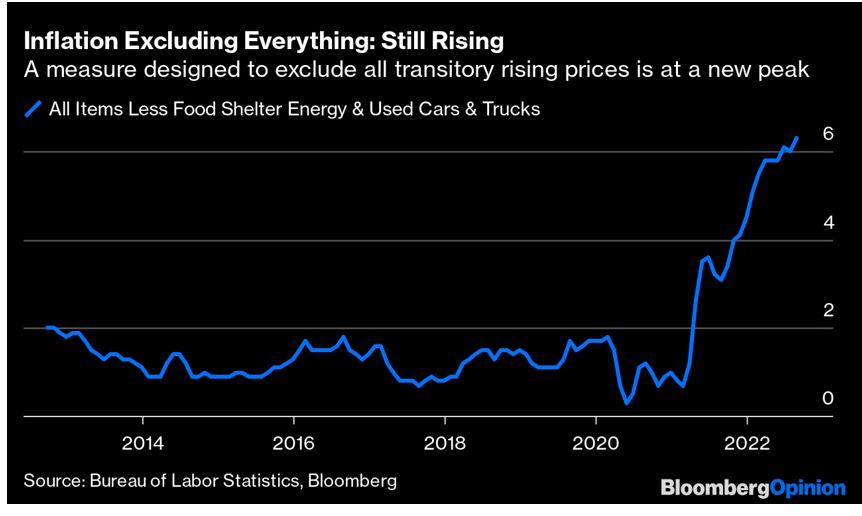

Chart of the week

The chart from Bloomberg Opinion highlights that inflation’s more ‘sticky’ components are still rising. The measure excludes the more volatile and transitory segments of the Headline CPI inflation reading, including food, shelter, energy, and used cars and trucks. The breadth and persistence of sticky inflation readings spooked the markets this week as the Fed will likely have to keep interest rates higher for longer to control inflation.

–

Friday 23 September 2022, 2pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.