A surge in bond yields tempered the equity market rally, with high growth stocks suffering the most. The Australian 10-year yields hit 1.9% whilst U.S. 10-year yields breached 1.6% before retracing to 1.4%. The S&P/ASX 200 fell 1.6%, led by a 12.7% sell-off in tech. The S&P 500 fell 2.4% whilst emerging markets, the star performer for the year so far, took a 5.7% tumble as measured by the MSCI Emerging Markets index.

It was another earnings heavy week in Australia. Woolworths (WOW) reported strong figures driven by retail and liquor, more than offsetting weakness in the hotels business. Like Coles (COL), a slowdown in sales growth was flagged, though WOW was notably more upbeat.

Sydney Airports (SYD) reported a net profit loss as it awaits a recovery in air travel, though its balance sheet remained strong as it looks to weather through to the other side of the pandemic. Seek (SEK) reported as well, with a strong operating environment for its core job sites but saw a sell-off as it announced a partial sale of its Zhaopin stake at a lower-than-expected valuation.

LendLease (LLC) posted figures that showed a continued recovery, with big improvements in both core revenues and earnings for the construction and development segments. The stock outperformed as management also noted that operating conditions were recovering towards pre-pandemic levels.

Appen (APX) reported earnings at the upper end of recently downgraded guidance, but the stock was hurt on a lack of clarity provided around a recovery from the weak December quarter. Despite strong project and customer growth, this growth did not flow through to guidance, with guidance coming in over 15% below consensus and management continuing to cite uncertain conditions. Whilst valuations look attractive with the price back to March lows and earnings are expected to grow at “just” 18-28% this year excluding currency effects, we expect that APX needs to show progress in converting projects to revenue for the market to take notice again.

NextDC (NXT) also reported, raising its full year guidance slightly to $246-251 million in revenues. The data centre company continues to see improving utilisation as it continues to build out further capacity. Expansion projects remain on track, with capital expenditure expectations held steady.

IOOF (IFL) also reported strong revenue and profit growth over the previous year thanks to the ANZ P&I contribution. Management remains optimistic on completing the MLC purchase before 30 June and on their ability to draw massive synergies from both the ANZ P&I and MLC acquisitions. However, we think it is still too early to tell. If management can deliver the cost synergies whilst minimising the outflow of funds under advice, IFL would be well positioned to deliver strong returns for investors. It will be a difficult journey and will likely take a couple of years to play out.

A2 Milk (A2M) posted a mixed result, downgrading guidance once again as the daigou and cross-border e-commerce channels remain weak. To re-activate these channels, A2M will be providing incentives and assistance to these channels which are expected to impact margins for the year. Whilst these channels remain an issue as international travel remains restricted, China retail store sales beat expectations with a 45.2% growth in revenues, indicating that A2M’s branding and demand remains strong. This is an encouraging indicator that the weakness in the other channels may be transitory. Another positive was strong growth in liquid milk sales in both Australia and the U.S., with the U.S. market another big potential source of growth for the company in the future, though A2M’s foray into this market is still young and will likely take a couple more years to become a significant part of revenues.

Elsewhere, Macquarie Group (MQG) upgraded guidance for the year as it flagged a much stronger Commodities and Global Markets performance on the back of the Texas freeze. It now expects a 5-10% growth versus previous guidance of profits being slightly lower than the previous year. Nufarm (NUF) also provided another trading update, which once again showed a continued recovery across all business lines, with Europe and Australia both benefitting from better weather. It is a traditionally slow period for NUF with the bulk of activity coming in the months ahead as the Americas and Europe come out of their winter periods but management is optimistic that the strong sales momentums will continue through.

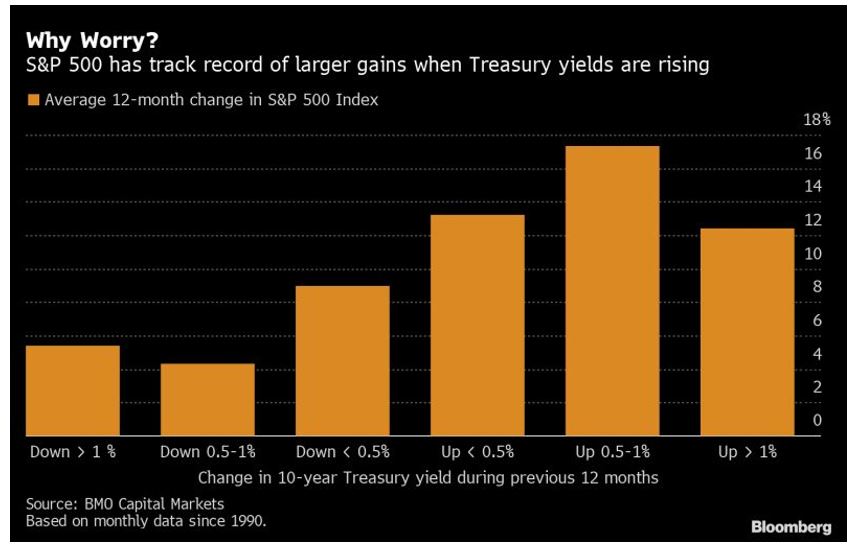

Higher yields don’t necessarily mean equity losses

Historically, equity markets have tended to rise as yields rise.

The reason behind this is that yields tend to rise in strong economic environments, meaning equities tend to see stronger profit growth that outpace the contraction in valuation metrics such as price to earnings multiples.

However, there are definitely implications to equities as yields rise. High flying growth stocks that have done so well in the past year tend to underperform. The reason for this is that the bulk of value for these stocks are derived from profits far into the future. As the discount rate rises, profits further out are impacted more when discounted back to their worth today. To compare this to bonds, higher growth stocks are longer duration, meaning that as yields rise, the capital values of these companies are expected to fall.

Up until the vaccine news in November last year, market leadership was firmly in growth stocks, but rising yields have driven a shift in leadership to value. This is likely to continue as long as yields continue to rise, but central banks globally are unlikely to sit idly by if yields continue to push higher and threaten the economic recovery.

The U.S. Federal Reserve has already tried to talk down rising yields, whilst this week, the Reserve Bank of Australia will likely do the same at its press conference post its monthly policy meeting.

–

Tuesday 02 March 2021, 9am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.