Key economic releases last week

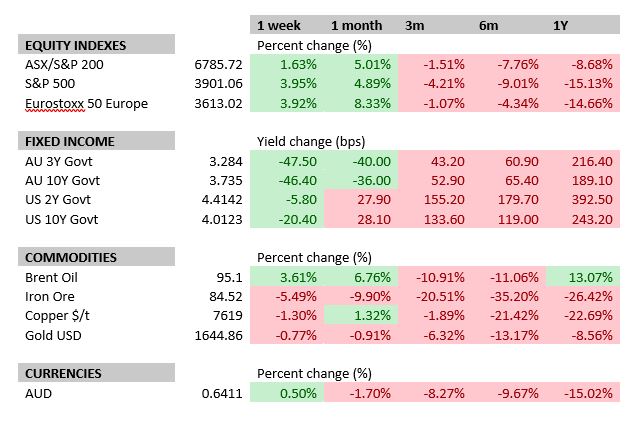

- Aus Q3 inflation was hotter than expected, coming in at 1.8% QoQ and 7.3% YoY, while trimmed mean was also 1.8% QoQ and 6.1% YoY, both above expectations.

- US, EU, Aus preliminary PMIs were generally weaker than expected and all except domestic manufacturing were below the 50 mark which separates expansion from contraction. The global economy is slowing as monetary tightening is starting to make an impact. The question for markets will be how much evidence is required for central banks to pause on hiking rates.

- US Q3 GDP came in at 2.6%, above consensus of 2.4%

- US core PCE inflation was in-line with expectations but remains well above the central bank target at 0.5% MoM. The US Federal Reserve needs core inflation to slow to a run-rate of 0.2-0.3% MoM to reach its targets and the risk remains skewed to continued hawkishness and something structural breaking, hence we remain conservatively positioned for now.

- US personal spending remains resilient with spending rising 0.6% MoM, above consensus of 0.4%. Consumer confidence fell below expectations but remains at levels that indicate a resilient consumer

- ECB hiked rates by 0.75% to 1.5%, in-line with consensus expectations.

- China Q3 GDP of 3.9% was better than the 3.4% expected. Industrial production for September grew 6.3% YoY, well above expectations for 4.5% but fixed asset investment of 5.9% was under the 6% consensus, retail sales grew 2.5% versus the 3.3% estimate and unemployment rate was 5.5% compared to the 5.2% consensus.

Key releases for the week ahead

- Aus retail sales

- RBA policy meeting – 0.25% hike expected

- US Federal Reserve policy meeting – 0.75% hike expected

- US labour data

- EU preliminary inflation and GDP

- US, EU, Aus PMIs

- Chinese PMIs

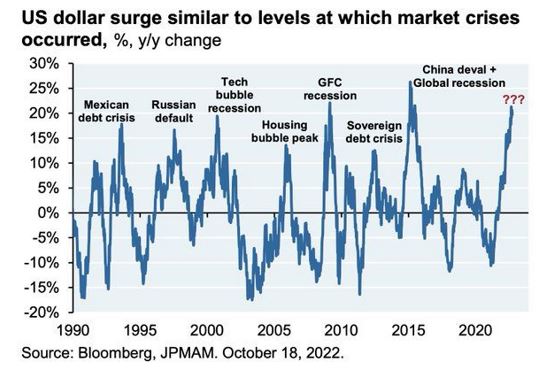

Chart of the week

The US Dollar has been strengthening all year. While the impact is mixed at the stock level, with many companies being beneficiaries given US Dollar based earnings, sharp surges in the US Dollar tends to lead to crises. Historically, emerging market currencies are the most at risk, though this year it seems that it is developed market currencies like the Euro or the Pound that are at risk. The stronger USD also drives weaker global earnings, especially for the mega-cap US tech companies, with the likes of Apple, Alphabet and Meta all seeing impacts to revenue and earnings growth in the mid to high single digit ranges.

–

Thursday 03 November 2022, 9am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.