It was another ugly week for equity markets, with global recession fears sending stocks sharply lower. The US S&P500 Index fell 5.8%, the STOXX Europe 600 fell 4.6%, and the Australian S&P200 finished the week 6.6%. China’s equity market bucked the trend and rose 1.4% in the wake of stronger than expected economic readings.

Australian shares faced broad-based selling, with all 11 market sectors sharply lower. It was the worst week for the market since the Covid meltdown in March 2020. On a relative basis, Telecoms (-2.4%) and Consumer Staples (-3%) outperformed, with investors favouring defensive sectors. Technology was the worst performer falling almost 10%, impacted by rising yields. Energy (-8.2%) and Materials (-7.7%) were hit by falling commodity prices on global slowdown fears. The Big 4 banks did not fare much better, with CBA, Westpac and ANZ all setting their 52-week low on bad debt fears rising and a weakening residential real estate market.

US 10-year bond yield hit a decade high of 3.49% on Tuesday. The yield fell back to 3.24% by Friday on positive commentary by Fed Chief Powell that the US could avoid a recession. The Fed raised interest rates by 75 basis points on Wednesday to 1.75%, the most significant jump since 1994. These sharp interest rate rises will likely be negative for consumer demand and company earnings, leading to future earnings downgrades. Powell reiterated a commitment to tackling inflation, signalling another 0.75% raise may be necessary for July. Notably, it appears the Fed is now expecting and willing to force a slowdown to bring inflation lower.

The Australian 10-year bond yield crossed 4%, rising 46 basis points over the week to 4.13%. Robust Australian employment data set the scene for further interest rate hikes. May employment figures were stronger than expected, with 60,600 jobs added compared to consensus expectations of 25,000. Underlying data was also strong as full employment drove the job additions, and the under-utilisation rate fell to a 40-year low. The Fair Work Commission moved to lift the minimum wage by 5.2%. The rise will likely have some trickle-down impact on broader wages, making the RBA’s job more difficult.

The European Central Bank held an unscheduled meeting amid fears of a new debt crisis after a jump in borrowing costs for heavily indebted member states. They declared they would take action to tackle widening yield spreads between economically strong and weak member states. Continuing the theme of central bank hikes, the Swiss National Bank unexpectedly raised interest rates for the first time in 15 years to subdue inflation. The Bank of England joined the party by raising its key interest rate by 0.25% and revising its inflation outlook to a peak of 11%. Official data also showed that the UK economy unexpectedly shrank in April.

China’s fixed-asset investment, retail sales, and industrial production figures bear expectations highlighting their budding recovery. We expect this positive momentum to continue due to stimulus measures and a reopening from lockdowns. However, the zero-COVID policy continues to be a source of significant uncertainty.

For the week ahead, RBA minutes and RBA Governor Lowe’s speech on Tuesday will help guide investors on the path of interest rates. Business condition purchasing manager indexes for Australia, Europe, and the United States will also be released later in the week.

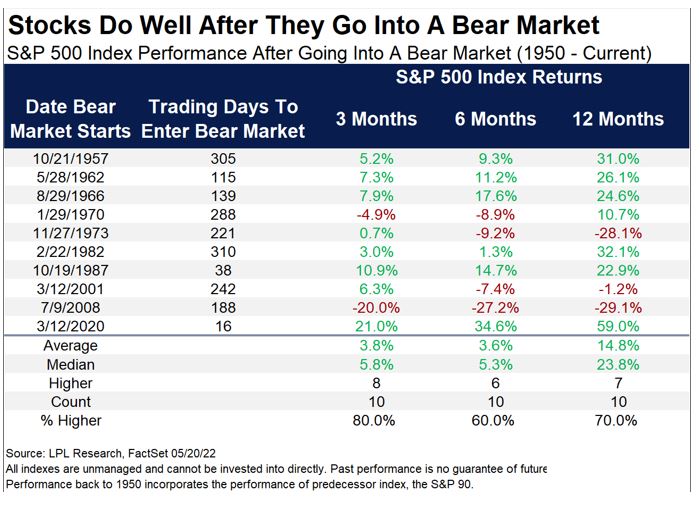

History of bear market returns

The US S&P500 and the MSCI All County World Index officially crossed into a bear market last week, falling over 20% from their peak.

Market corrections are a characteristic of investing. While they are incredibly uncomfortable to experience, taking a historical view, we can observe that investors have been well rewarded by riding out these periods of volatility.

Since 1950, there have been ten other bear markets for the S&P500 index. The median rise for the SP500 12-months after entering a bear market is 23%. There are no guarantees that this pattern will repeat. In fact, in 1973 and 2008, when the economy entered a deep recession, the market was materially lower in the following 12 months.

As discussed previously, we believe corporate earnings forecasts risk downgrades in the face of rising costs and slowing demand. If this plays out, there would likely be another leg down for stocks. We tilted our asset allocation more defensively on this risk. However, we think it is essential to maintain historical context during this unsettling period – investors who hold their nerve during difficult times are often rewarded. While we are not there yet, there will again be the time to position the portfolios more aggressively.

–

Monday 20 June 2022, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.