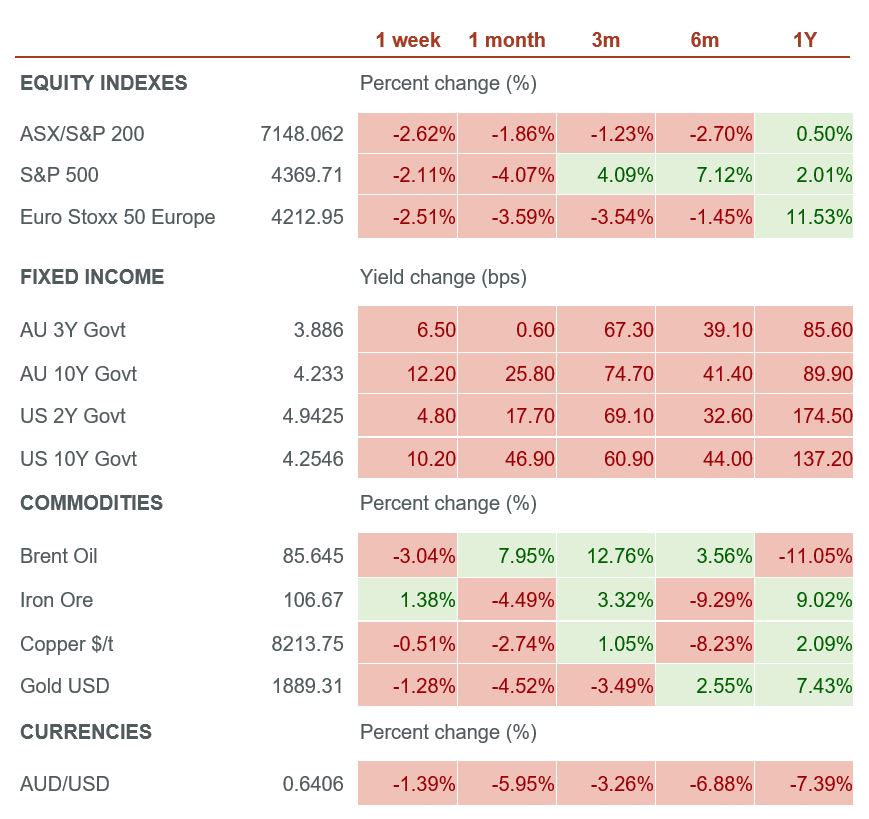

Key economic releases last week

- Australian employment data was weaker than expected, with employment falling 14,600 compared to consensus expectations for 15,000 jobs added. The unemployment rate rose to 3.7%. This may allow the RBA to continue to refrain from hiking again and to assess the economy as a large number of fixed rate mortgages start to roll onto much higher rates.

- US retail sales rose 0.7% MoM, well above consensus expectations for 0.4% growth. The core reading rose 1% MoM compared to consensus for -0.3% as the US consumer remains resilient.

- EU preliminary GDP matched estimates, growing 0.3% QoQ and 0.6% YoY

- EU industrial production surprisingly rose in 0.5% MoM in June, with the YoY fall limited to 1.2% compared to consensus expectations for -4.2%.

- EU inflation was in-line with consensus, core and headline both fell 0.1% MoM, with the YoY at 5.5% and 5.3% respectively.

- China fixed asset investment (3.4% YoY compared to 3.8% consensus estimate), industrial production (3.7% YoY compared to 4.4% estimate) and retail sales (2.5% YoY compared to 4.5% estimate) all disappointed. The unemployment rate rose 0.1% to 5.3%. The PBoC cut the medium term loan facility by 0.15% to 2.5% and the short term facility by 0.1% on the back of broadly disappointing data. China’s economic growth continues to struggle worse than anticipated. Data across the board is weak and default concerns are returning with the largest real estate developer, Country Garden, missing payments. This is spilling over to other sectors with the Chinese government promising further support but providing little detail.

Key releases for the week ahead

- Australian, EU, US preliminary PMI data

- US housing data

- PBoC policy meeting

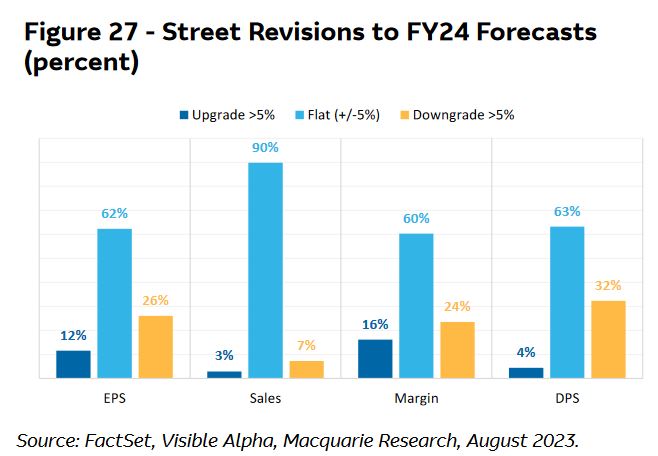

Street Revisions to FY24 Forecasts

We are currently in the thick of the domestic reporting season. While not a disaster, results have so far been weak relative to historical trends, with the ratio of companies beating on earnings largely in-line with those missing. Adding to the disappointment, guidance has been weak, driving significantly more downgrades than upgrades.

There are some bright spots within segments of the market. For example, retailers have largely had positive results and guidance as consumer spending has remained resilient and costs have largely been passed through without a major impact on demand. However, like our macroeconomic view on a potential recession being pushed out rather than avoided, we think the cyclical downside to earnings has also been pushed out rather than avoided.

We are only about halfway through earnings season so it is still too early to conclude overall earnings trends for the ASX 200 at this stage, but the initial signs are for downgrades to the outlook for the 2024 financial year. Therefore, we retain a conservative outlook for equities.

–

Tuesday 22 August 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.