Key economic releases last week

- Employment in Australia increased by 64.6k jobs, breaking a streak of two consecutive months of job losses. This exceeded the consensus estimate of 48.5k jobs added. Additionally, the unemployment rate fell from 3.7% to 3.5%.

- According to the NAB business survey, while current conditions remain solid, business confidence continues to weaken significantly.

- The Westpac consumer sentiment remained stagnant for the month, remaining near record lows. However, forward-looking expectations improved, while current expectations continued to deteriorate.

- The US CPI data was largely in line with expectations, though the core MoM reading of 0.5% exceeded the consensus estimate of 0.4%. Services inflation continues to be a concern, as it remains high and tends to be more persistent. However, goods inflation is no longer an issue, supported by the PPI data that was below expectations.

- US retail sales experienced a 0.4% MoM decline, which was slightly below the consensus estimate of -0.3%.

- The EU inflation data was in line with estimates, with a 0.8% MoM reading for both core and headline. This remains above the target run rate, which will keep the ECB hawkish despite banking system issues.

- Despite recent banking issues, the ECB raised rates by 0.5% to 3% due to persistent high inflation.

- China’s fixed asset investment was higher than expected, while retail sales were in line with estimates. However, industrial production came in below expectations and the unemployment rate rose slightly. The lack of significant positive surprises in China’s recovering economy is weighing on markets.

- The People’s Bank of China cut the reserve requirement ratio from 11% to 10.75%, injecting liquidity into the system.

- UBS has made an agreement to acquire Credit Suisse (CS), their Swiss competitor, for CHF3 billion. CS was experiencing a crisis of confidence that had the potential to spread to the entire financial system. Depositors were withdrawing their funds from the bank at a rapid rate due to concerns about the bank’s stability, which risked becoming a self-fulfilling prophecy. The sale of CS was hastily arranged by Swiss authorities over the weekend in an attempt to alleviate the markets concerns. We will discuss this and its implications for markets in a separate note to clients, similar to our note on Silicon Valley Bank.

Key releases for the week ahead

- US Fed policy meeting and interest rate projections.

- US Housing Data.

- Preliminary Purchasing Managers’ Index (PMI) data for Australia, the EU, and the US.

Chart of the week

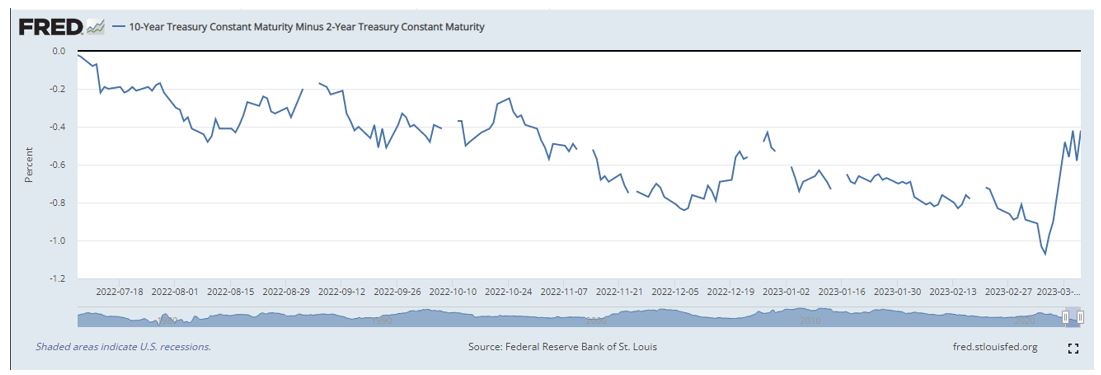

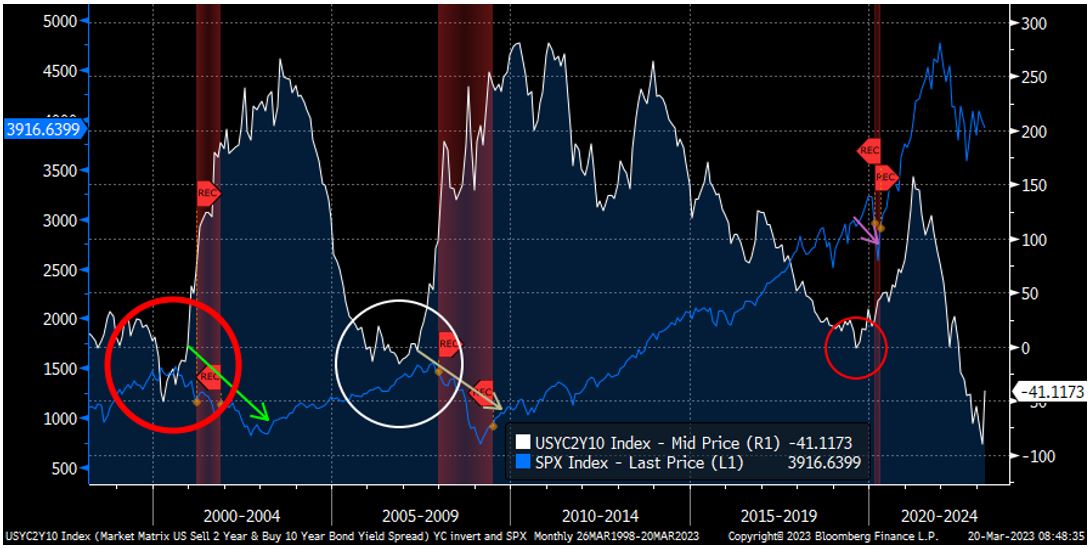

Since early July 2022, the US 2-year Treasury note and 10-year Treasury note have been inverted. Typically, yield curves slope upward because investors demand a higher yield for holding long-term bonds. This is because longer-term bonds carry more uncertainties such as inflation, interest rate or default risk.

Yield curve inversion is a rare phenomenon that occurs when yields on longer-term bonds become lower than yields on shorter-term bonds. This has been a reliable predictor of economic recessions in the past.

On March 8th of this year, the spread between the two- and 10-year Treasury yields widened to 107 basis points, which was the deepest inversion since 1981. However, since then, there has been a strong rebound of the yield curve inversion, which currently sits at approximately 40 basis points. Even though the yield curve is still inverted, we can see from the graph below (created in Bloomberg) that historically, the end of yield curve inversion has been bearish for stock market returns, as it often correlates with the beginning of a recession. This is why we have adopted a defensive asset allocation strategy. The blue line represents the S&P 500 equity index (LHS) while the white line represents the two- and 10-year Treasury spread.

–

Tuesday 21 March 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.