Key economic releases last week

- Australian earnings season – key trends from results so far: FY22 was still strong overall but we are seeing some signs of deterioration in forward looking comments and guidance. Margin pressure is a common feature, with many seeing costs to remain elevated for FY23.

- Domestic employment data was weaker than expected as 40,900 jobs were shed while consensus expected 25,000 jobs to be added. The unemployment rate fell to 3.4% despite the job losses as the participation rate fell by 0.4% to 66.4%.

- US retail sales were flat MoM while the core reading grew 0.4%, indicating that the US consumer continues to be resilient despite the collapse in confidence surveys.

- Chinese fixed asset investment, industrial production and retail sales were all below consensus and so weak that the People’s Bank of China cut the 1-year mortgage lending facility and 7-day repo rates in its wake.

Key releases for the week ahead

- Another busy week for Australian Earnings season with companies including Wesfarmers (WES), Coles (COL), Seven Group (SVW), and IDP Education (IEL) all reporting.

- Business conditions PMIs for Australia, the US, and Europe will be released.

- Commentary by US Fed Chairman Jerome Powell at Jackson Hole regarding the outlook for inflation and interest rates

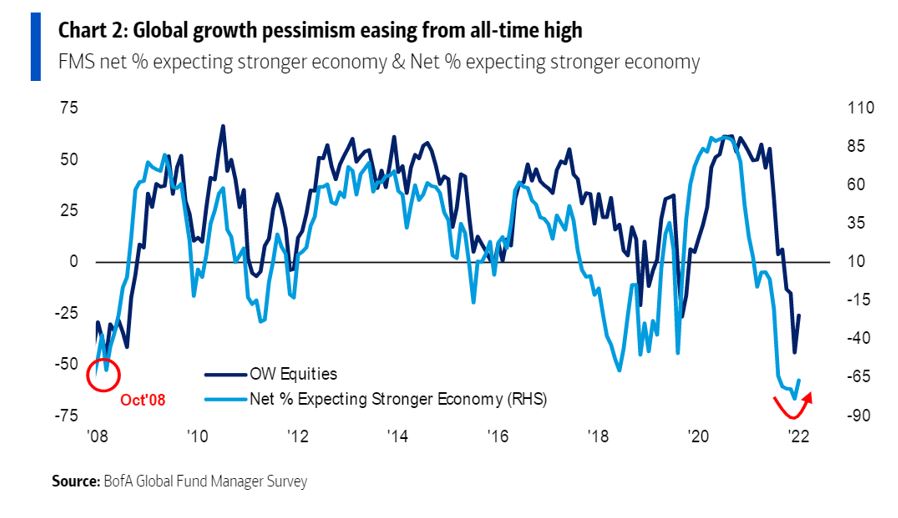

Chart of the week

According to the Bank of America global fund manager survey, sentiment of large money managers has started to shift up from recent lows. The optimism comes from hopes that peak-inflation is already in and on the back of stronger than feared earnings reports. If more professional investors continue to shift to overweight equity positions in the coming months, flows into equities will help to sustain the recent rally. Though it must be noted that investor sentiment is volatile and negative inflation surprises could quickly reverse this trend.

–

Monday 22 August 2022, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.