Geopolitics continues to drive markets in the near-term as the Russian troops remain on the Ukraine border, though underneath the broad market selloffs on headline news, it still looks like monetary policy is driving the market as global equities were, once again, dragged lower by tech and other growth stocks. The MSCI World fell 1.7% as the S&P 500 fell 1.5% and the U.S. Dollar strengthened on broad risk-off sentiment. The S&P/ASX 200 bucked the trend with a 0.3% gain, with a strong slate of positive earnings reports helping to support the local market.

Healthcare (+3.9%) led gains thanks to a big rally from heavyweight CSL after a strong earnings report, while Tech (-2.8%) continued to lead declines. It was a busy week for earnings, with 9 of the top 20 reporting. BHP, Goodman Group (GMG) and Woodside Petroleum (WPL) had strong results alongside CSL, while Wesfarmers (WES) and Fortescue Metals (FMG) disappointed. Transurban (TCL), Telstra (TLS) and Santos (STO) had mixed results. Of the other companies of interest to us, Challenger (CGF), Newcrest (NCM), Treasury Wine (TWE), Seek (SEK), Dexus (DXS), Breville (BRG), Cleanaway (CWY) and Promedicus (PME) all had solid results. Given the sheer volume of reports, we won’t cover each in detail this week but there were several trends that we would like to highlight. First is that most companies are seeing supply chain issues worsen due to the impact of Omicron, while labour availability issues are starting to clear up as cases fall. Second is that cost pressures continue to mount, particularly for labour and transport, impacting everyone from miners to retailers. With this backdrop, we continue to favour companies that have better management and pricing power that can help navigate supply chain issues or pass-through rising costs.

In fixed income, Australian bond yields were largely higher on the back of another strong set of employment data. 12,900 jobs were added in January despite Omicron running rampant, defying consensus forecasts for job losses. Meanwhile, global bond yields were largely lower despite U.S. producer price inflation coming in higher than expected, as markets placed more weight on the Russia-Ukraine issue.

Looking to the week ahead, while headlines will likely continue to be dominated by the Russia-Ukraine issue, it is another big week for local earnings, with Sonic Healthcare (SHL), Coles (COL), Rio Tinto (RIO), Woolworths (WOW) and Brambles (BXB) among the larger names to report. On the macro front, preliminary Purchasing Manager Indices survey results are due, while U.S. consumer confidence and personal spending will be closely watched. However, the focus may be on U.S. Personal Consumption Expenditure (PCE), which is an inflation reading that is closely watched by the Federal Reserve.

The case for Australia to outperform

Australian equities have had a good start to the year, relative to the rest of the world, down just 2.8%, compared to the MSCI World which is down 7.4% and the U.S. S&P 500 which is down 8.6%. Having been an underperformer for more than a decade, there are several positives for equities down under to come out on top.

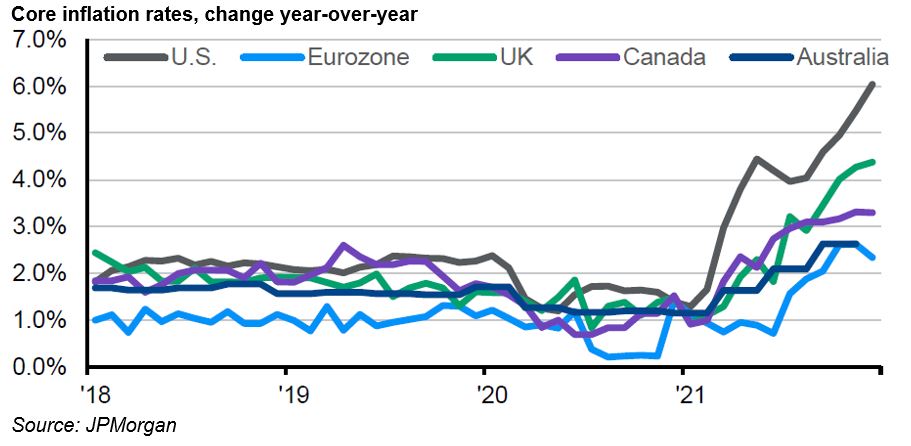

Currently, the main worry is high inflation forcing central banks to accelerate monetary policy tightening. As the chart below shows, Australia’s core inflation remains relatively muted, and the Reserve Bank of Australia is still one of the less hawkish central banks in the developed world, outside the Bank of Japan which has broken from the herd with plans to buy unlimited quantities of its 10-year government bonds.

The domestic economy is also holding up well. Despite the impact of Omicron, many companies have noted that early February trends point to a swift recovery in their guidance. Business confidence and consumer sentiment have also remained positive despite the surge in cases, as strict lockdowns seem to have become a thing of the past, at least for now. Indeed, despite the disruptions caused by Omicron, jobs were added in January, and Australia now has more workers than ever before.

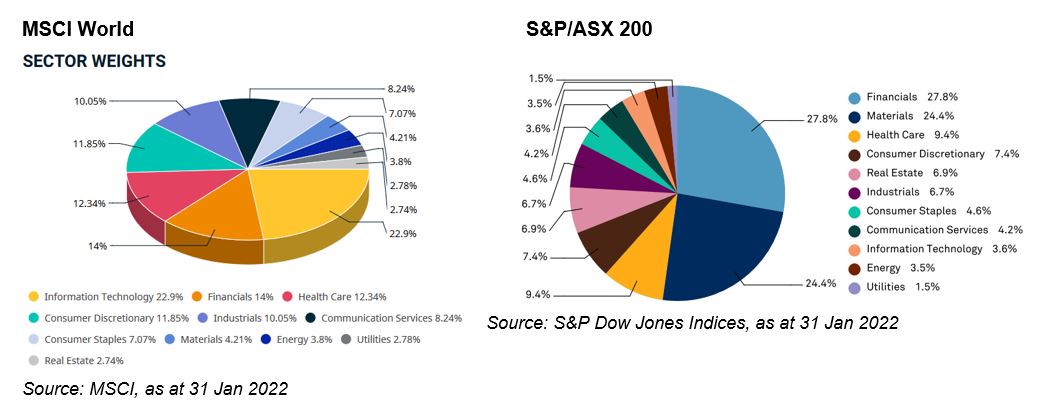

While it is too early to tell, recent market movements could be the beginning of a regime change, whereby rising yields mean valuations become more of a focus, and value-style investing starts to outperform again. This would be beneficial for the domestic index as the S&P/ASX 200 has a significant weight in so-called value sectors such as financials and materials, relative to the MSCI World or the S&P 500. At the same time, there is lower exposure in the S&P/ASX 200 to growth sectors such as Tech and Healthcare.

A further rise in yields, higher structural inflation and resilient growth would strengthen the basis for a regime change, but we currently think that there is still too much uncertainty in the outlook due to the ongoing impact of COVID on supply chains and demand, especially with the risk of further variants. As a result, our model portfolios currently only have a slight overweight to domestic equities relative to global equities.

–

Tuesday 22 February 2022, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.