Key economic releases last week

- Westpac consumer sentiment fell 7.9% compared to the -1.7% consensus as the RBA’s surprise rate hike reversed the sentiment bounce post the short pause. The fall was driven by both current and future expectations for family finances and the economy.

- Australian employment data was weaker than expected, with 4,300 jobs lost against consensus for 25,000 jobs to be added, driven by a drop of 27,100 for full time jobs. The unemployment rate rose 0.2% to 3.7%.

- US retail sales disappointed, rising 0.4% MoM and 1.6% YoY compared to a 0.8% MoM and 4.2% YoY consensus estimate.

We are seeing signs of deterioration in the US economy after a resilient start to 2023. We remain cautious as we continue to see a recession as likely this year. - EU inflation data was in-line with expectations. Core rose 5.6% YoY while headline rose 7% YoY.

- EU Q1 GDP grew 0.1% QoQ and 1.3% YoY, in-line with expectations.

China data were all weaker than expected as the recovery stalls. Fixed asset investment +4.7% vs +5.5% consensus, industrial production +5.6% vs +10.9% consensus and retail sales +18.4% vs +21% consensus. While the initial recovery was much better than expected, the reopening boost is now disappointing as consensus expectations have risen and the recovery moderated at the same time. This has led to weakness in commodities and other China-related exposures.

Key releases for the week ahead

- Australian preliminary retail sales

- US, EU, Australian preliminary PMIs

- US personal consumption expenditures price index

- US personal spending

- US preliminary Q1 GDP

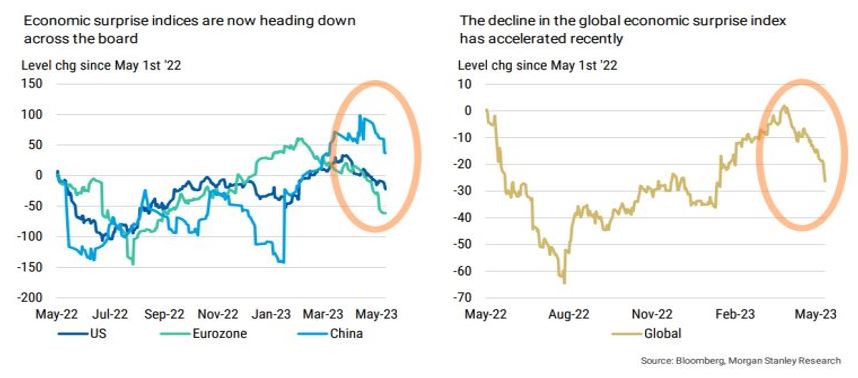

Chart of the week

Global economies and markets have had a surprisingly robust start to the year, wrong footing many in the process. However, it is notable that economic data has been deteriorating relative to expectations since late March. This has been driven by a combination of rising expectations after a strong start to the year, and a fading of economic strength as China’s economy has been more pedestrian after a blistering reopening start while the US banking issues are likely to have deterred some activity with further slowing due to tighter credit conditions still to come.

The deterioration in economies is a key reason we remain cautious in our positioning. Meanwhile, valuations are also not at attractive levels with earnings expectations still looking lofty for an ongoing slowdown and a likely recession. On the more optimistic side, according to investor surveys and fund flows, positioning is already conservative. This may help cushion markets from a deep sell-off.

–

Monday 22 May 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.