Key economic releases last week

- Australian employment data was stronger than expected. 32,200 jobs were added compared to expectations for 15,000, and the unemployment rate fell to 3.4%. Q3 wages rose by 1%, more than the 0.9% consensus.

- US retail sales was stronger than expected, with headline and core both rising 1.3% MoM compared to consensus of 1% and 0.4% respectively. Consumer spending has been robust, defying weak sentiment.

- EU inflation was largely in-line with consensus but remains at high levels with core at 0.6% MoM and headline rising 1.5% MoM.

- China fixed asset investment rose 5.8%, industrial production rose 5%, retail sales fell 0.5% and unemployment was steady at 5.5%. The readings were largely below consensus, with retail sales the most disappointing given that consensus expected a 1% increase.

- In another sign of US inflation surprising to the downside, PPI readings came in below estimates, with the MoM headline at 0.2% and core at 0%, well below the consensus for 0.4% and 0.3% respectively.

Key releases for the week ahead

- Australian, EU, US preliminary Purchasing Manager Indices

- US Federal Reserve minutes

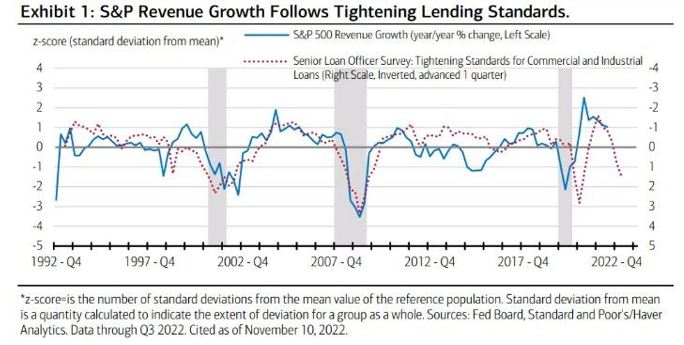

Chart of the week

The chart above demonstrates that US S&P500 earnings growth tends to track lending standards for commercial and industrial loans. This makes intuitive sense as companies often require access to capital to fund growth projects. The Senior Loan Officer Survey conducted by the St Louis Fed demonstrates that lending standards have recently tightened in the rising rate environment, potentially indicating S&P revenue growth may be subdued going forward.

–

Tuesday 22 November 2022, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.