Key releases last week

- Westpac Consumer Sentiment rose 5% on improved outlooks for the economy but remains in negative territory. Meanwhile, house price and employment expectations continue to decline.

- Australian employment fell 14.6k compared to expectations for a 22.5k increase. The unemployment rate rose 0.1% to 3.5% despite the participation rate also falling from 66.8% to 66.6%.

- US retail sales were weaker than expected, falling 1.1% MoM compared to consensus -0.8%, while industrial production fell 0.7% MoM compared to consensus -0.1%.

- US core Producer Price Inflation (PPI) rose 0.1% MoM, in-line with consensus, while headline fell 0.5%, more than the expected -0.1%.

- EU inflation data was in-line with expectations, with core rising 0.6% MoM and 5.2% YoY.

- China fixed asset investment rose 5.1% YoY vs 5% consensus, industrial production rose 1.3% YoY vs 0.2% consensus, retail sales fell 1.8% YoY vs -8.6% consensus and unemployment fell to 5.5% vs 6% consensus. The official data points to a significant recovery in December despite reports of surging infections.

- China GDP was flat for Q4 and up 2.9% for 2022, beating consensus estimates of -0.8% and 1.8% respectively.

Key releases for the week ahead

- NAB Business confidence

- Australian inflation readings

- US PCE and personal spending

- Australian, EU, US preliminary PMI readings

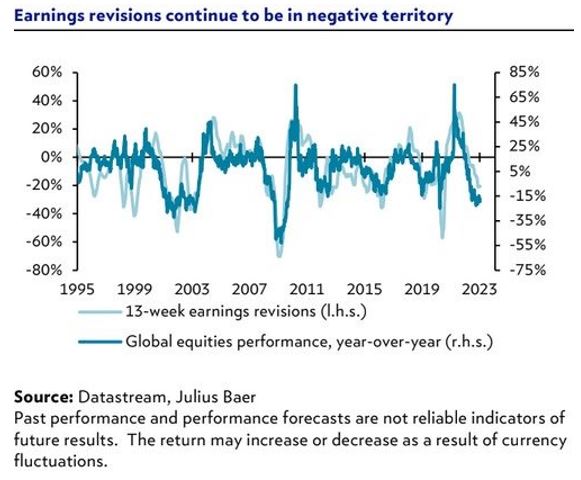

Chart of the week

Global earnings revisions continue their negative trend. Analysts are concerned about the ability of firms to maintain profit margins that hit decades highs during the pandemic. Also, there are worries about consumer demand falling in a tougher economic climate. We believe these negative earnings revisions still have some way to go, and given the correlation between earnings revisions and equities performance, our positioning remains conservative for now.

–

Monday 23 January 2023, 3.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.