Key economic releases last week

- Australian employment data was mixed as only 6,700 jobs were added compared to expectations for 18,000 as full employment fell by 39,900. However, the participation rate fell 0.3%, driving the unemployment rate 0.1% lower to 3.6%.

- US retail sales were strong, rising 0.7% MoM compared to 0.3% consensus. Core sales rose 0.6% compared to 0.2% consensus.

- China GDP rose 1.3% QoQ and 4.9% YoY, above consensus of 1% and 4.4% respectively.

- China fixed asset investment rose 3.1%, 0.1% below consensus. Industrial production rose 4.5%, retail sales rose 5.5% and unemployment rate fell to 5%, all above consensus.

- The data was better than expected, especially for retail sales, which could indicate that Chinese consumer activity is starting to pick up. The stronger than expected readings could relieve pressure on the Chinese government to significantly increase stimulus measures – a potential headwind to demand for Australian resources.

- EU inflation data was in-line with consensus, rising 0.3% MoM or 4.3% YoY at the headline CPI level, and 0.2% MoM or 4.5% YoY at the core level.

Key releases for the week ahead

- Australian Inflation

- Australian, US, EU preliminary PMI readings

- US PCE inflation data

- US personal spending

- ECB policy meeting

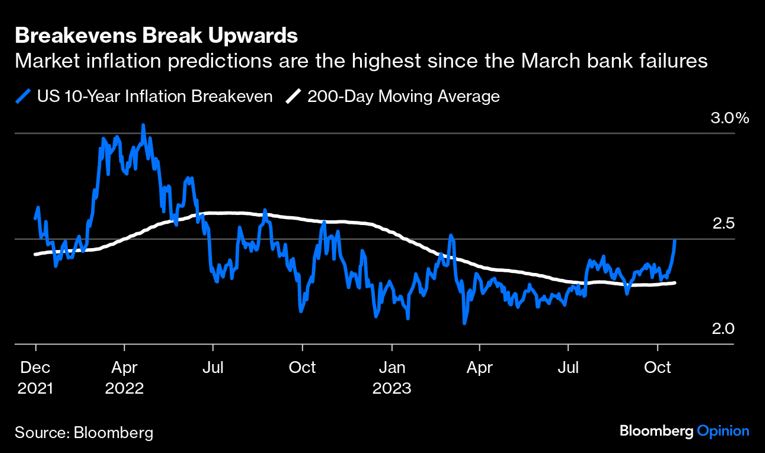

Chart of the week

As we’ve previously mentioned, we see the final leg of the Fed’s battle to sustainably return inflation to its 2% target as the most challenging. In the last week, US retail sales figures smashed estimates and showed the remarkable strength of the US consumer. Simultaneously, escalating tensions in the Middle East have driven a surge in oil prices.

These recent events alongside the uptick in core and supercore month-on-month inflation readings over the past few months, have led the market to lift bets on longer-term inflation expectations. The US 10-year inflation breakeven has reached 2.5%, a level we haven’t seen since the US bank failures in March. This suggests that faith in the defeat of inflation is starting to waver among participants.

These new data points affirm our belief that the current economic outlook is highly uncertain and volatile. However, such heightened volatility often opens the door to attractive investment opportunities. While we maintain a cautious approach to our positioning, we’re actively monitoring the situation for favourable risk-adjusted chances to deploy capital.

–

Monday 23 October 2023, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.