Key economic releases last week

- US and EU preliminary PMIs were largely better than expected, with services remaining in expansionary territory and improving further compared to consensus expectations for deterioration. US manufacturing also rebounded into expansionary territory.

- The Australian preliminary PMIs were better than expected as services rebounded into expansionary territory with a 52.6 reading, while manufacturing deteriorated less than expected to 48.1.

- EU inflation data was largely in-line with expectations as CPI rose 6.9% YoY with core at 5.7%. The worrisome trend is that MoM readings remain too high at 0.9% for the headline and 1.3% for core.

- US housing data continues to trend weaker.

- China’s GDP grew 4.5% YoY compared to expectations for 4%, largely as Q4 2022 figures were revised higher. Industrial production grew 3.9% YoY and fixed asset investment grew 5.1%, both missing estimates of 4% and 5.7% respectively. However, retail sales were strong, growing 10.6% YoY compared to estimates for 7.4%. The Chinese economic rebound continues to surprise to the upside but is largely driven by consumers. This is less impactful for ASX equities as commodities are not seeing the historical boost from a rebounding Chinese economy as stimulus shifts away from construction to other areas of the economy.

Key releases for the week ahead

- Australian inflation data

- US consumer confidence and personal spending

- US personal consumption expenditures

- US preliminary GDP

- EU GDP

- US mega-cap tech reports Q1 earnings

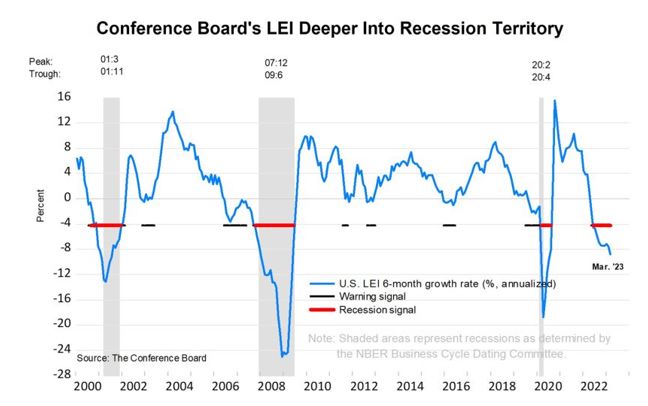

Chart of the week

While global economic data has been better than expected, driven by positive Chinese and European economic surprises, we continue to be concerned about an imminent recession in the US. The chart below is the leading economic index put out by the US Conference Board, indicating that the US should be entering a recession soon or is in one already.

While markets have moved positively as yields have fallen, we do not expect the central bank to cut interest rates as quickly as the market has priced in due to elevated and sticky inflation unless systematic issues arise. As a result, we expect a difficult environment for risk as earnings are pressured by an economic slowdown. Credit spreads and equity P/E multiples remain at long term averages rather than cheap levels, therefore, we remain cautious on both a valuation and macroeconomic perspective.

–

Monday 24 April 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.