Key economic releases last week

- Australia posted another strong set of employment data, with 32,600 jobs added as the unemployment rate held steady at 3.5%.

- US retail sales rose 0.2% for both core and headline readings, missing consensus estimates for 0.3% and 0.5% respectively.

- EU CPI rose 0.3%, in-line with consensus, while the core reading rose 0.4%, above the 0.3% consensus.

- China GDP grew 0.8%, more than consensus for 0.5% but this was offset by downward revisions to previous quarters, with the YoY figure rising 6.3% compared to consensus expectations for 7.3%.

- China fixed asset investment grew 3.8% compared to 3.5% consensus, industrial production grew 4.4% compared to 2.7% consensus, retail sales grew 3.1% compared to 3.2% consensus, unemployment was flat at 5.2%.

Key releases for the week ahead

- Australian inflation data

- Australian, EU, US preliminary PMI readings

- US consumer confidence and personal spending

- US personal consumption expenditure

- US Federal Reserve policy meeting

- EU Central Bank policy meeting

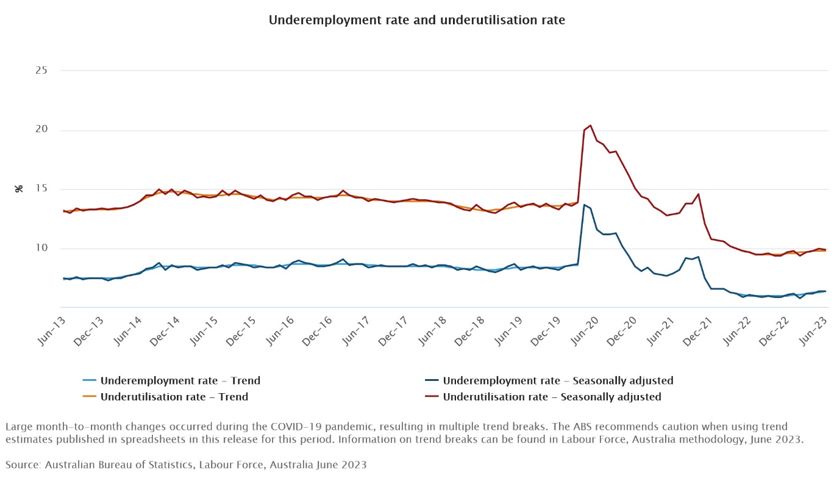

Underemployment rate and underutilisation rate

Employment data in Australia continues to be surprisingly strong. Like many other developed economies, despite deterioration in leading indicators such as consumer and business sentiment or Purchasing Manager Indices (PMIs), the unemployment rate has remained low and employment numbers continue to tick higher. Second order measures such as the underemployment rate and underutilisation rate remain resilient, though they have very marginally deteriorated from the lows seen at the start of 2023.

While this is usually seen as a positive for the economy, when taken in the context of the RBA fighting inflation, it makes it more difficult to envision a scenario where inflation rapidly returns to the target band. This potentially forces the RBA to have to continue to increase interest rates or hold them at higher levels for longer, impacting borrowers at a time when household debt, predominantly driven by mortgages, remain at record high levels. This raises the potential risk and magnitude of a policy error given the long and variable lags of monetary policy impact. Therefore, while markets remain sanguine in the short-term thanks to resilience in economic data, we remain cautious on the medium-term outlook.

–

Monday 24 July 2023, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.