Key economic releases last week

- Australian employment data was much weaker than expected, adding 900 jobs vs 25,000 expected. The participation rate and unemployment rate held steady at 66.6% and 3.5% respectively. These are indications that monetary policy tightening is having an effect domestically and the labour market is less imbalanced compared to the US.

- China economic data was postponed as focus turned to the two-week congress where President Xi is expected to be re-elected for a third term.

- EU inflation figures rose in-line with expectations, with core at 4.8% YoY and 1% MoM while headline was 9.9% YoY and 1.2% MoM.

Key releases for the week ahead

- Australian Q3 inflation

- Australian Federal Budget

- US, EU, and Australian preliminary Purchasing Manager Indices

- US Q3 GDP

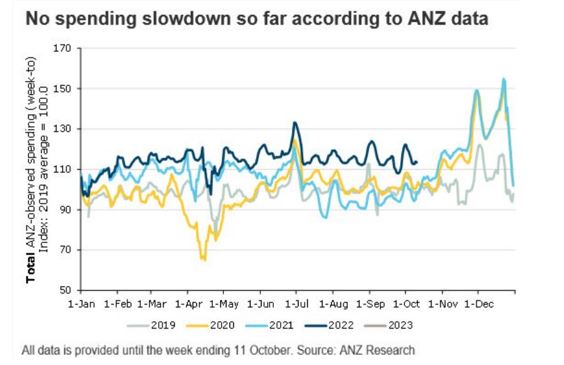

Chart of the week

ANZ Research data demonstrates that consumer spending remains elevated compared to the last three years. Interest rate hikes have yet to curb spending, potentially indicating further rises may be on the horizon as the RBA looks to cool the local economy.

–

Monday 24 October 2022, 2.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.