The rebound continues for equities while bond yields resume their upward move. U.S. quarterly earnings season continues to deliver strong results, providing support for equities as the S&P 500 outperformed other major markets with a 1.7% return. The MSCI World had a 1.2% return while the S&P/ASX 200 underperformed with a 0.7% rise. The financial, tech and consumer discretionary sectors led gains with all three rising 2% for the week. Energy was the worst performer with a 4.3% fall as it retraced some of the big gains over the past month.

Bond yields have risen significantly and are now close to the highs reached in late February as the Australian 10-year yield hovers at 1.8%, despite the Reserve Bank of Australia reiterating its stance on not raising rates until 2024.

On the economic front, Chinese economic data continues to disappoint with GDP for the third quarter growing at a measly 0.2% over the previous quarter. Evergrande eased concerns by announcing that it had paid its coupons due 23 September, avoiding a default, but market reaction was muted as it continues to sit on a mountain of debt. We expect that the Chinese government will likely manage the situation to prevent a broader crisis but the longer this drags on, the higher the risk that it will be too little too late. Overall, we remain cautious on China and the broader emerging markets for now as we await a loosening of monetary policy and a return to growth for credit in China.

Domestically, we are already seeing a bounce from NSW’s easing of restrictions, with payroll numbers tracking higher and preliminary activity survey results indicating a bounce back to growth. These signs point to a quick rebound in employment and the economy as Victoria also starts to ease restrictions.

In corporate news, we are seeing several trading updates, with BHP, Santos (STO) and Woodside Petroleum (WPL) slightly missing production estimates while OZ Minerals (OZL) upgraded its outlook for gold production on better grades. Brambles (BXB) had better-than-expected sales figures but maintained its guidance for the full year as it warned on supply chain issues and rising costs.

Elsewhere, Aristocrat Leisure (ALL) is looking to acquire U.K.-listed Playtech, a provider of online gambling software, for $5 billion. It notes that Playtech operates in segments that have little overlap with the existing businesses and provides strong long-term growth potential. Execution will be the key to success. We think management have proven themselves over the years, consistently delivering on strategic targets and managing large acquisitions, so we view this move in a positive light.

This week, we will see many big tech companies reporting which could drive market sentiment in the near term. Domestically, we will see inflation readings and retail sales, while U.S. consumer confidence, personal spending and the European Central Bank policy meeting are also due this week. Investors will also be watching for any progress on the U.S. infrastructure bill after House Speaker Nancy Pelosi said that Democrats were close to finalising an agreement on Sunday.

Earnings help climb the wall of worry

In September, equities markets had a wobble after months of unrelenting gains. Rising yields, the delta variant, supply chain issues, slowing growth, the U.S. debt ceiling and potential fallout of Chinese property developers were all a drag on the market.

Then came earnings season. The big U.S. banks started with a bang as profits decimated estimates. The real positives were gleaned from strong corporate lending volumes that signalled strong animal spirits as businesses started to borrow and spend. Since then, U.S. S&P 500 earnings estimates for the quarter have risen from 27.5% growth as at the end of September 2021 to 32.7% as at 22 October 2021, driven by earnings beats by 84% of companies that have reported.

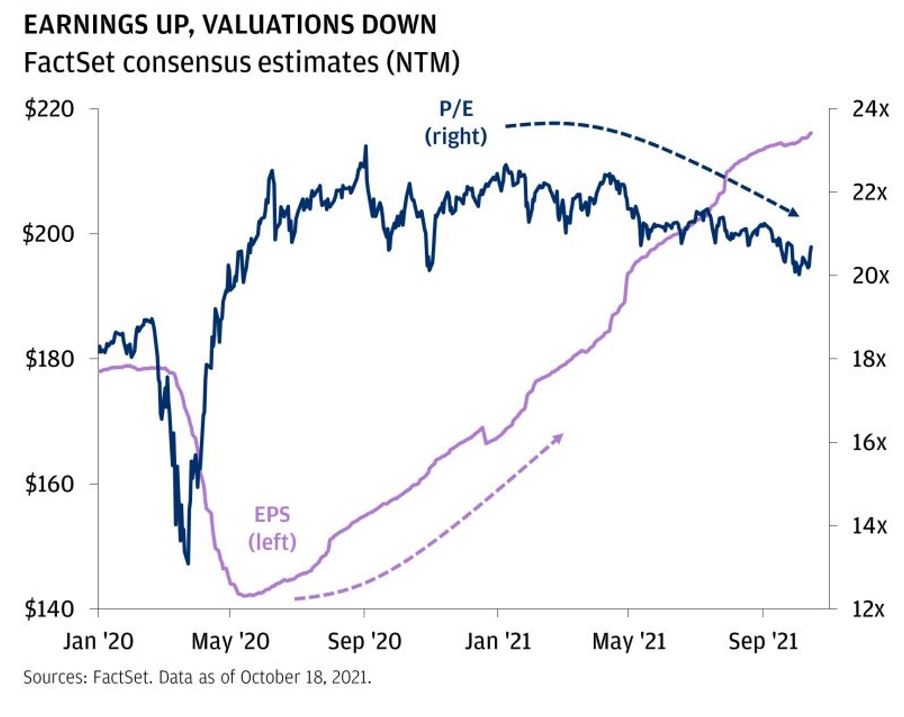

Strong earnings have driven a rebound in equities, with the S&P 500 hitting new record highs last week. While there has been talk about valuations being expensive based on price-to-earnings multiples that are above historical averages, this is not uncommon in the period following a recession where earnings have been depressed and earnings growth is likely to be strong as the economic rebound sets in.

Despite strong equity market gains, the chart below shows that price-to-earnings multiples based on forecasted earnings over the next year have moved lower from 22x at the start of the year to around 20x. This has been driving by rising expectations from strong results over the past few quarters.

So far, earnings season has supported the recent rebound, but this week may be key as Apple, Amazon, Alphabet, Facebook and Microsoft all report. Together, these five companies make up 22% of the S&P 500 and will be key for investor sentiment.

–

Tuesday 26 October 2021, 9.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.