Key economic releases last week

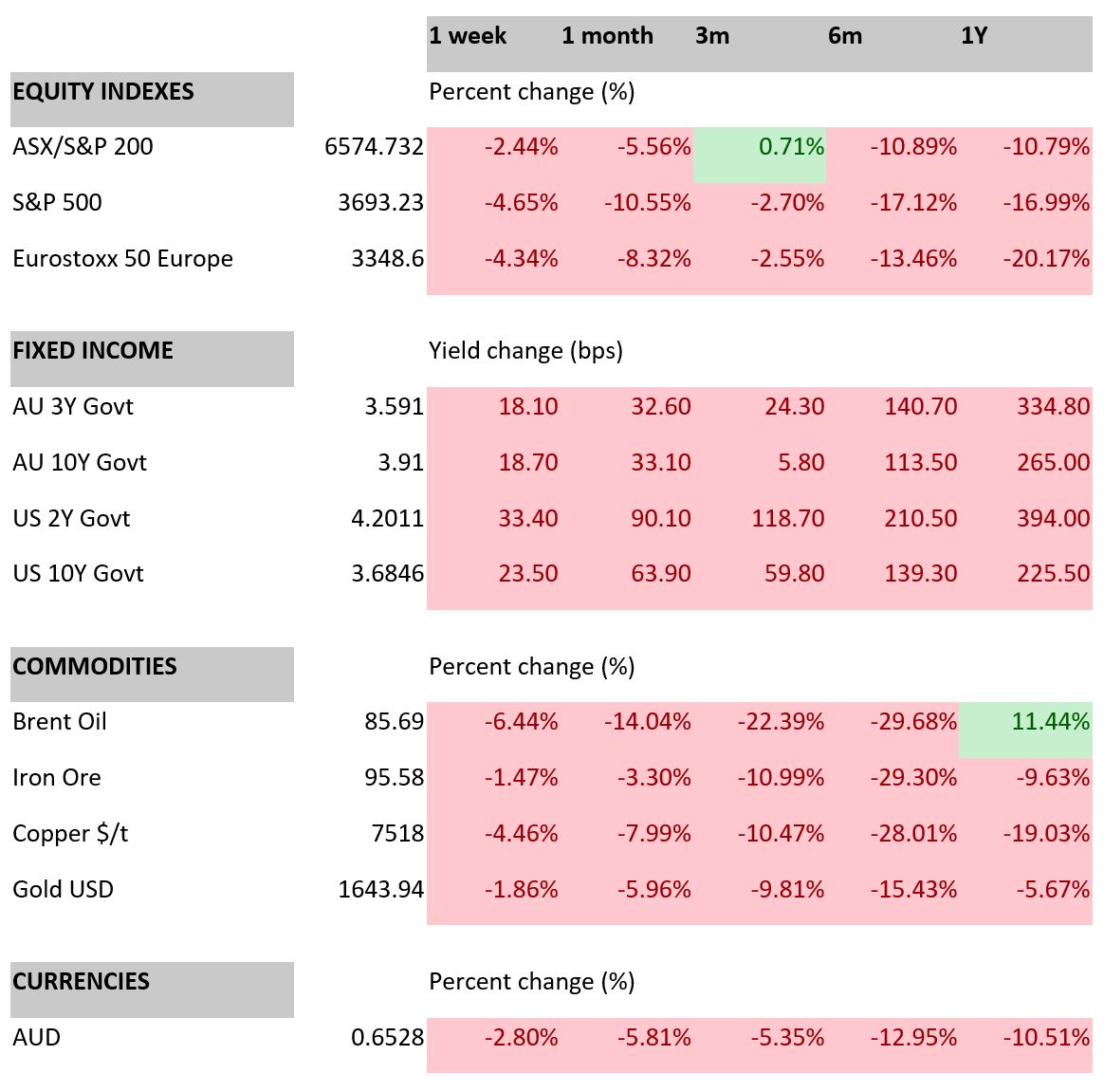

- Share markets were again under pressure on the back of hawkish Central Banks, rising bond yields, and growing recession fears.

- The US Federal Reserve increased interest rates another 0.75%. Fed officials were also very hawkish in their commentary and forecasts.

- The Bank of England hiked rates another 0.5%.

- An escalation of tension in Ukraine following Putin ordering Russia’s first military mobilisation since WW2 and threatening the use of nuclear weapons.

Key releases for the week ahead

- Australian ABS CPI inflation data for July and August

- US Consumer Confidence

- Eurozone employment and CPI inflation

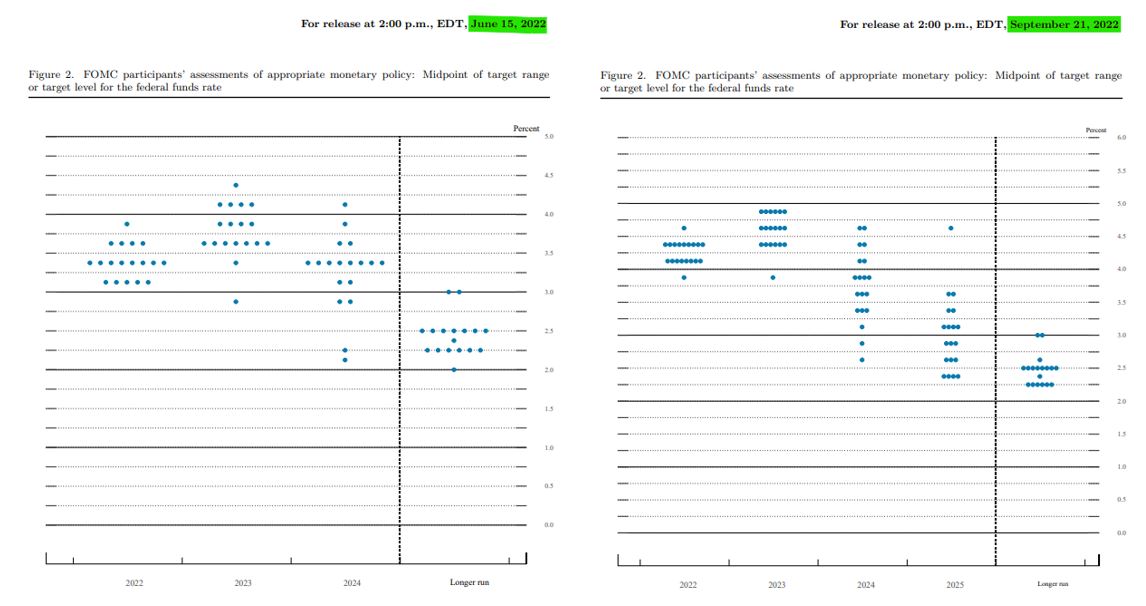

Chart of the week

The Federal Reserve “dot plot” chart is released quarterly and indicates each Fed official’s projection for the key short-term interest rate going forward. It is a volatile measure as the officials will update their projections based on evolving economic data. Chairman Powell has stated it should be taken ‘with a big grain of salt’. The latest “dot plot” released last week demonstrates that the official’s now project interest rates to be significantly higher in 2023 and 2024 that previously projected back in June 2022. In 2023, interest rates are now projected to be between 4.25-5%, whereas just three months back the majority projected the range to be 3.5-4.25%. This helped spark a sell-off in equity markets with bond yields rising and hopes of a Fed pivot fading.

–

Monday 26 September 2022, 11.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.