Key economic releases last week

- The US Fed kept rates on hold as expected but the quarterly interest rate projections indicated that another rate hike was likely by the end of the year while rates were also projected to stay higher for longer compared to the last quarter’s projections and market consensus. Chair Jerome Powell said that a soft landing was not their baseline expectation.

- The Bank of England surprised by holding rates steady.

- The Bank of Japan also held rates steady.

- The minutes from the latest RBA meeting showed that the RBA did consider hiking rates again but decided to keep rates on hold for now. Surging oil prices and the recent uptick in global food prices may be the catalyst for another rate hike later this year.

Key releases for the week ahead

- Australian August inflation data

- Australian Jobs data

- Australian Retail Sales

- US Personal Consumption Expenditure inflation

- EU inflation

Chart of the week

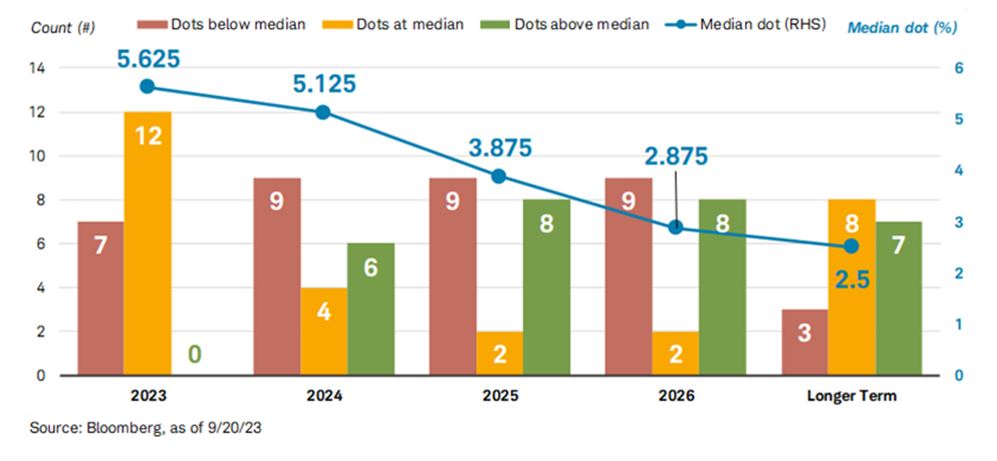

The Federal Reserve’s recent release of its quarterly Summary of Economic Projections indicates an extended period of higher interest rates, reflecting a stronger-than-anticipated economy. The 2024 median rate estimate has been revised upwards to 5.1%, compared to the previous 4.6% estimate in June. Additionally, the midpoint for 2025 rates has been adjusted to 3.9%, up from the prior projection of 3.4%.

Furthermore, the Fed has upgraded its GDP growth forecasts for 2023 (2.1%, up from 1% in June) and 2024 (1.5%, up from 1.1%), while concurrently reducing the expected unemployment rate to 4.1%, down from the previously predicted 4.5% in June.

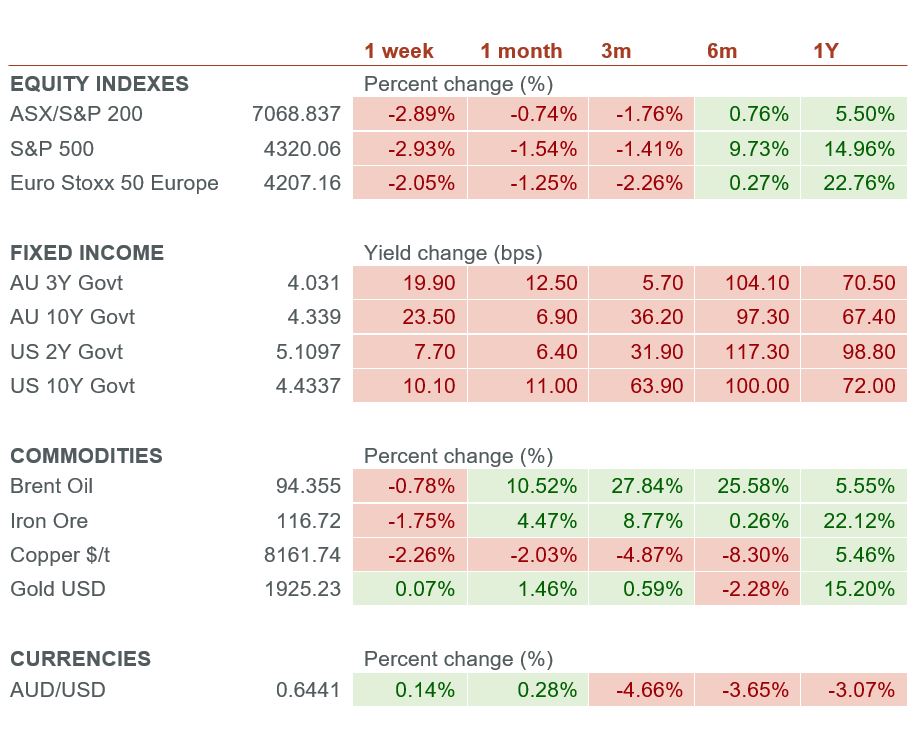

These upward revisions in the Fed’s projections have triggered a bond market sell-off. Notably, the US two-year Treasury yield, closely linked to official rate expectations, has reached its highest level since 2006, while the benchmark US 10-year bond yield has climbed to 4.4%, marking its highest yield since 2007. Moreover, real yields (bond yields adjusted for long-term inflation expectations) have surpassed 2% for the first time in over a decade.

The surge in bond yields poses challenges for stock valuations. As the relative attractiveness of bond investments increases due to higher yields, the discount rate applied to future company cashflows also rises. Also elevated borrowing costs can dampen economic activity. These dynamics underpin our current cautious equity positioning.

–

Tuesday 26 September 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.